Loan Servicing / Loan Activity / Loan Summary

Loan Summary

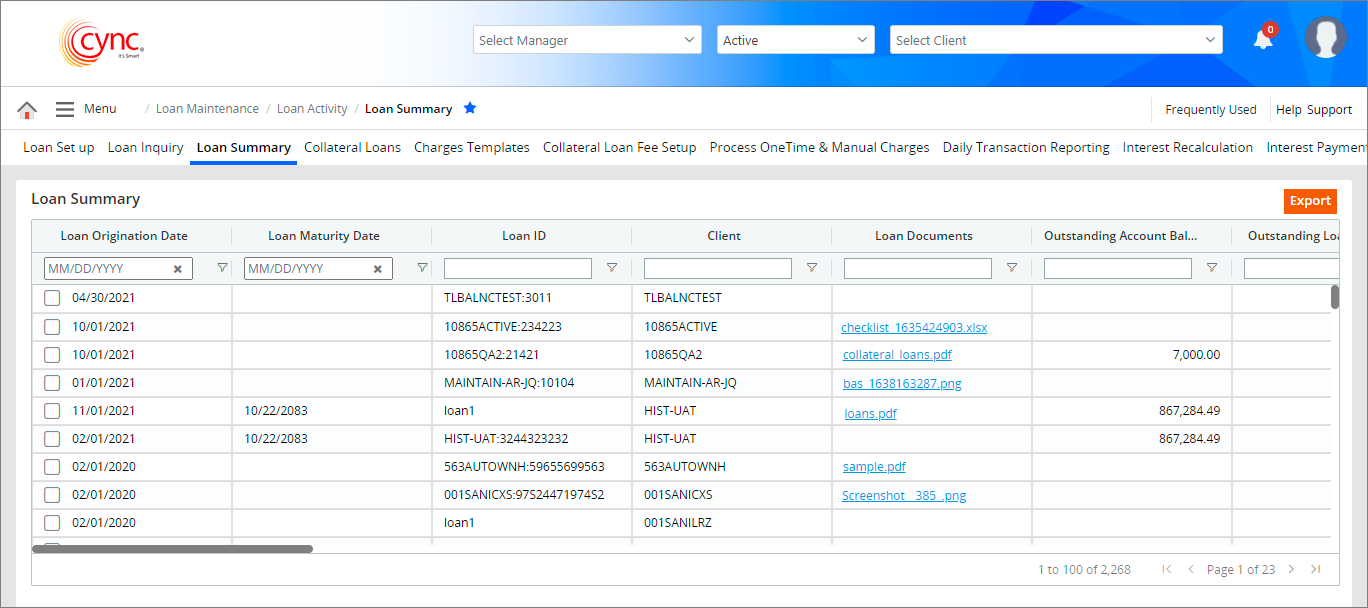

The Loan Summary page allows you to export the summary of all loan details.

Navigation: Loan Servicing → Loan Activity → Loan Summary

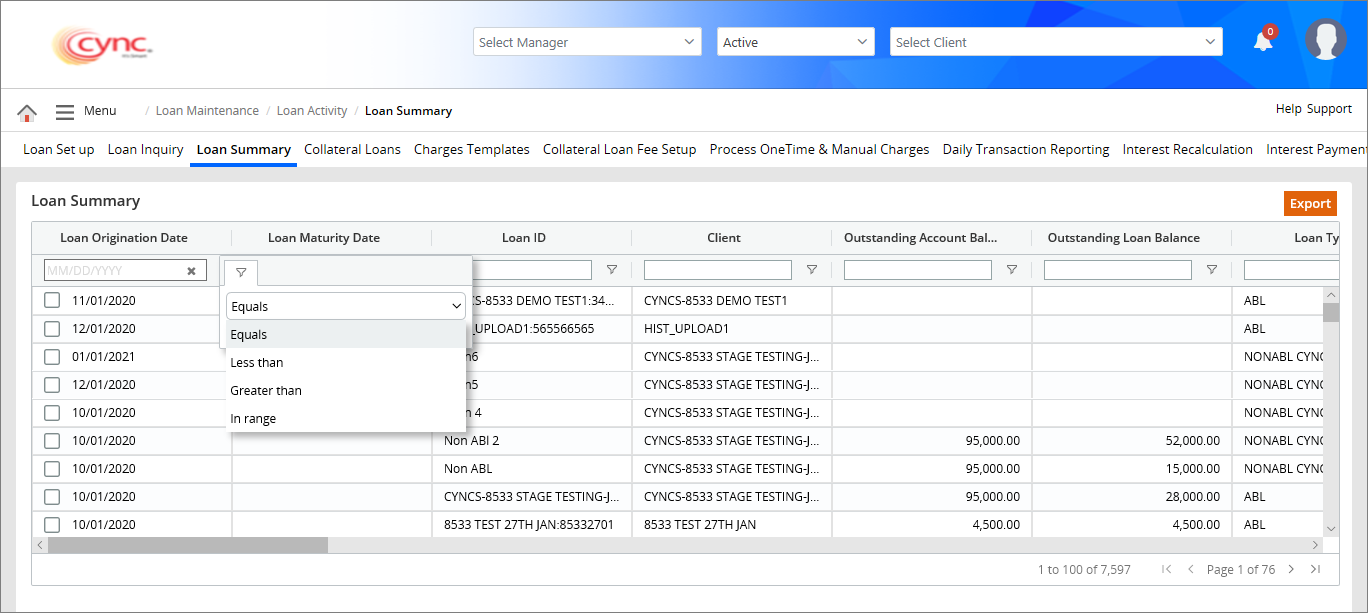

Refer to the screenshot:

Fields and Descriptions

|

Fields |

Descriptions |

| Loan Signed Date | Displays the date signed for the loan agreement. |

| Loan Origination Date | Displays the date on which the loan documents was signed with authorized signature. |

| Loan Maturity Date | Displays the expiration date of the loan. |

| Loan Paid off Date | Displays the date when the loan amount is paid off fully. |

| Loan ID | Displays the Loan ID of the client/borrower. |

| Loan Documents | Displays the hyperlink of the uploaded documents related to the specific loan. Allows the user to download the loan documents by clicking on the hyperlink and view the downloaded loan documents. |

| Loan Status | Displays the status of the loan such as Active or Inactive. |

| Client | Displays the client's/borrower's name for each loan transaction. |

| Client ID | Displays the client/borrower ID. |

| Loan Type | Displays the loan type. For example, ABL and Non ABL. |

| Interest % | Specifies the interest rate percentage for the loan. |

| Credit Ceiling Max | Displays the maximum amount of loan that the borrower can borrow. This field displays the value as same as the value defined in the Credit Line field under the Loan Set Up page for the respective Loan IDs. |

| Disbursement | Displays the disbursement amount. |

| Principal Paid | Displays the paid principal amount for each loan. |

| Principal Balance | Displays the principal amount which remains unpaid, for each loan. |

| Interest Accrued | Displays the accrued interest for each loan.

|

| Interest Paid | Displays the paid interest value for each loan. |

|

|

Displays the accrued fee for each loan. |

| Fee Paid | Displays the paid accrued fee value for each loan. |

| Fee Balance | Displays the accrued fee balance. |

| Outstanding Loan Balance | Displays the past due amount for each loan. |

| Outstanding Account Balance | Displays the sum of all loan balances for each client/borrower. |

| Interest Amount | Displays the interest amount of the loan. |

| Other fees | Displays the other fees charged for the loan. |

| UDF Field |

Specifies the User-Defined value. This field displays the value as same as the value inputted by the user in the custom UDF field of the specific loan under the Loan Set up page.

|

You may rearrange the order of the columns by dragging and dropping each column to the desired position and exporting the Loan Summary data based on user preferences. You may refresh the page to view the default order of the column.

You may rearrange the order of the columns by dragging and dropping each column to the desired position and exporting the Loan Summary data based on user preferences. You may refresh the page to view the default order of the column.

To export the loan summary details, perform these steps:

1. Go to Menu → Loan Maintenance → Loan Activity → Loan Summary. The Loan Summary page appears.

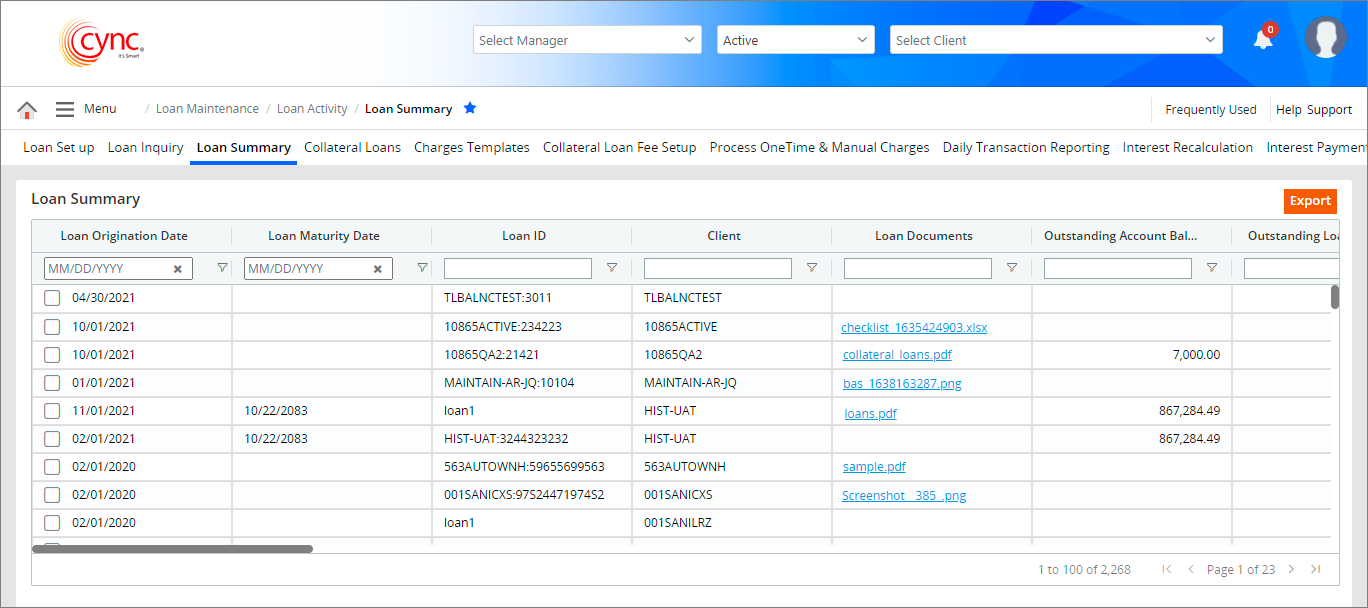

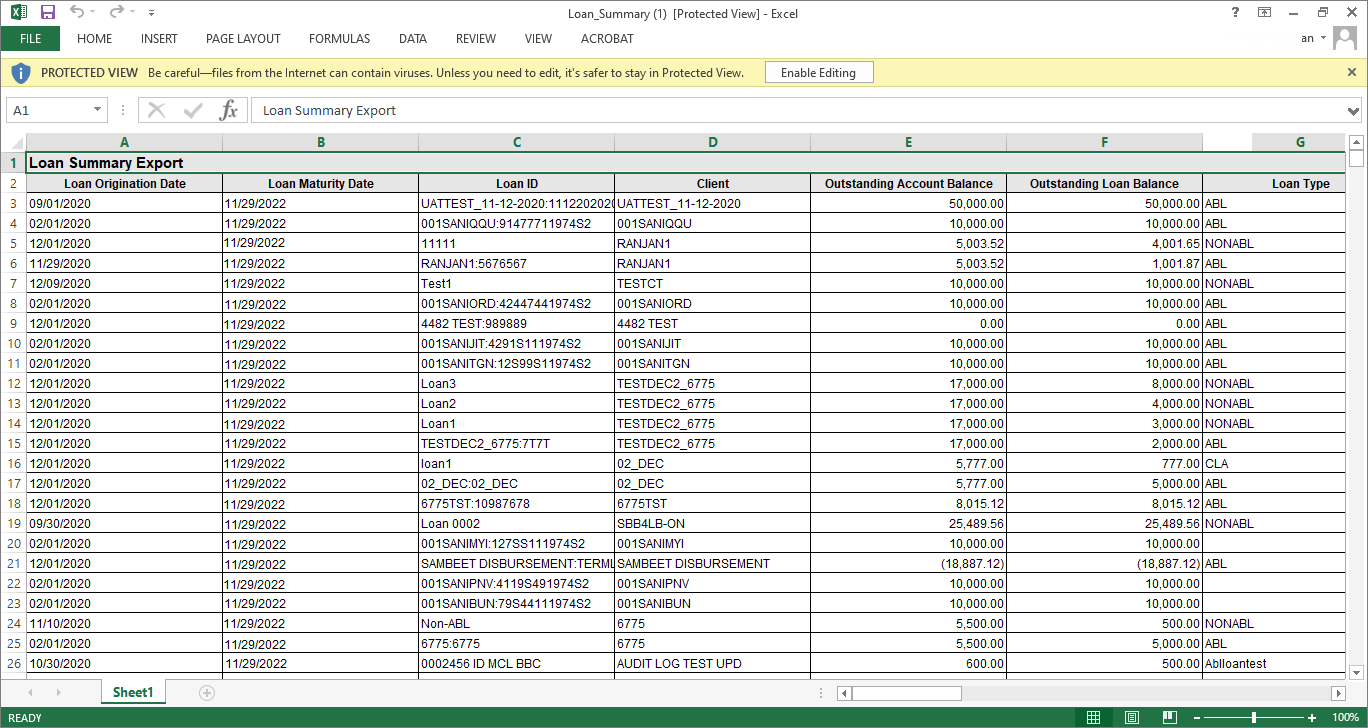

2. Click the  button. A pop-up message "Do you want to open or save loan-summary.xlsx from cyncsoftware.com" appears.

button. A pop-up message "Do you want to open or save loan-summary.xlsx from cyncsoftware.com" appears.

3. Click Open to view the loan transaction details. The loan transaction details are successfully exported.

Refer to the screenshot:

You may filter the Loan Summary data based on the required criteria, by clicking the ![]() icon.

icon.

Refer to the screenshot:

The filter criteria has the following options based on the field:

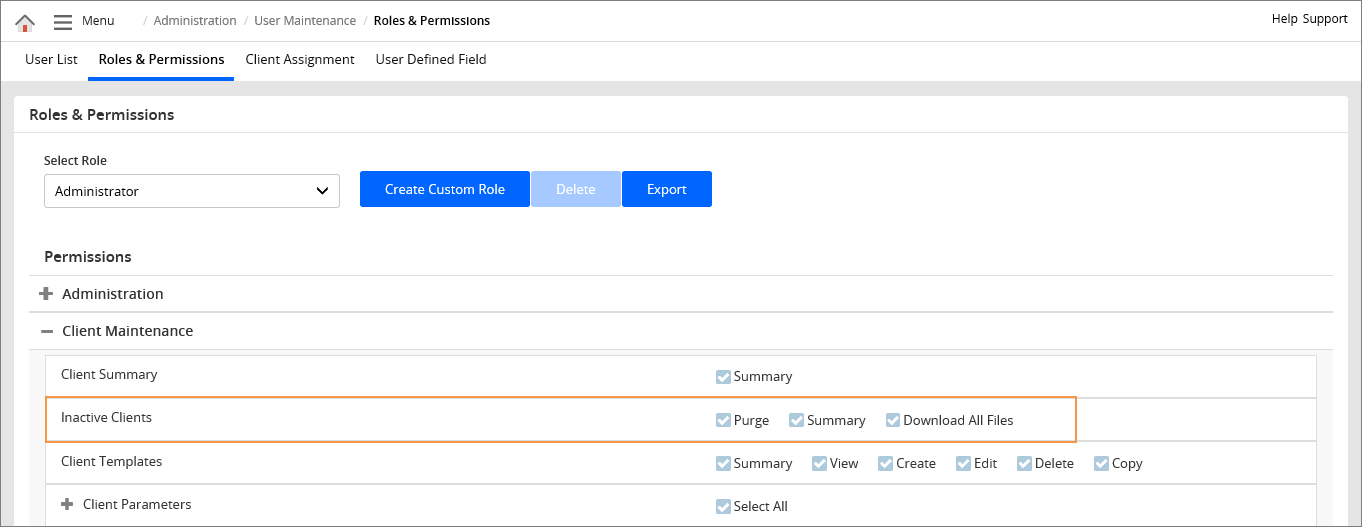

If the Inactive Clients options are checked OFF under Roles and Permissions page, then the system will display only active clients and will not display the inactive clients in Loan Summary page.

If the Inactive Clients options are checked OFF under Roles and Permissions page, then the system will display only active clients and will not display the inactive clients in Loan Summary page.

If the Inactive Clients options are checked ON under Roles and Permissions page, then the system will display both Active and Inactive clients in Loan Summary page.

If the Inactive Clients checkboxes are OFF under Roles and Permissions page for Portfolio Manager Role, then the Inactive Clients assigned to the portfolio manager and Inactive Clients assigned to executive manager under the same Portfolio Manager will not display in Loan Summary page.

Refer to the screenshot: