Loan Servicing / Loan Activity / Process One Time and Manual Charges

Process One Time and Manual Charges

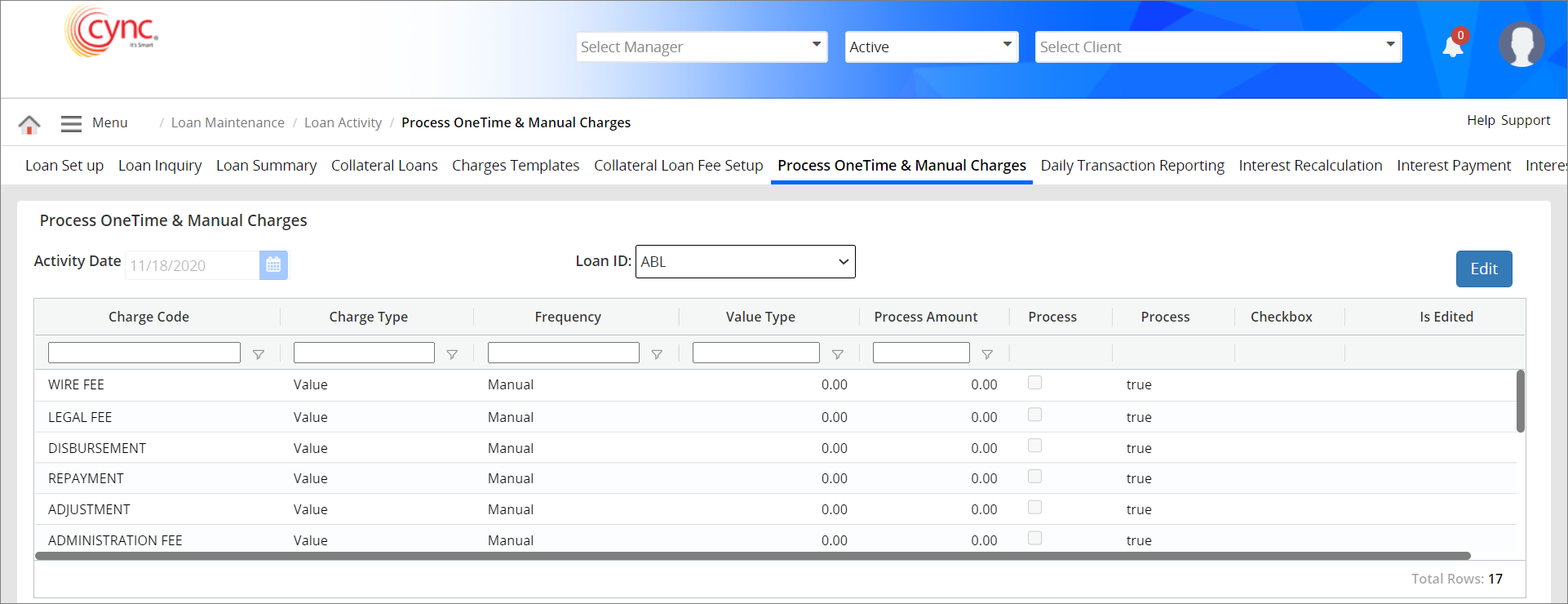

The Process One time and Manual Charges page allows you to enter charges manually. It is recommended that you use this screen instead of posting directly to the Collateral Loan screen for control reasons and to decrease the likelihood of negatively impacting the loan data. The charges can be applied for both ABL and Non-ABL loans.

Navigation: Loan Servicing → Loan Activity → Process One Time and Manual Charges

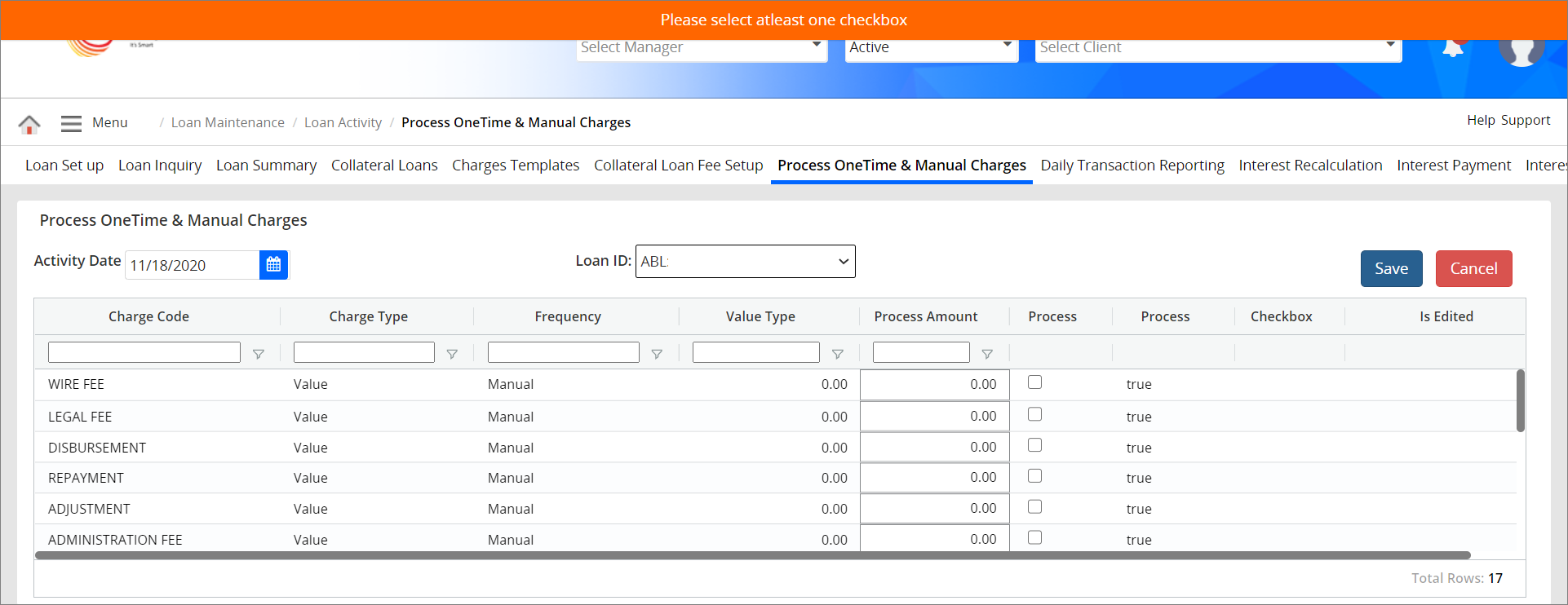

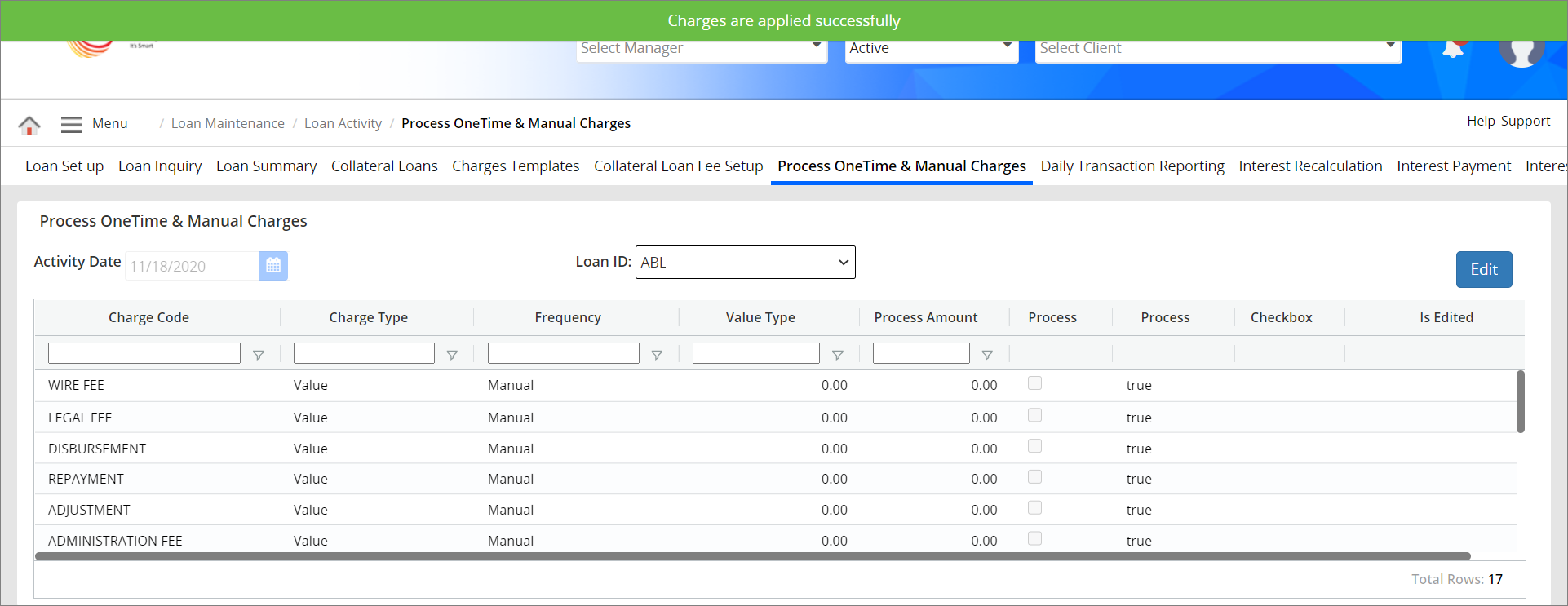

Refer to the screenshot:

Fields and Descriptions

|

Fields |

Descriptions |

|

Loan ID |

Allows user to select the Loan ID from the drop-down list. |

|

Activity Date |

Specifies the date on which to process the charge. |

|

Charge Code |

Specifies the charge to apply. |

|

Charge Type |

Specifies the Charge Type. For manual charges, the charge type will always be ‘value’. |

|

Frequency |

Specifies the frequency of the charge code. For manual charges, the charge type will always be either ‘Manual’ or ‘One-Time’.

|

|

Value Type |

Specifies the amount that was entered on Charges Template. |

|

Process Amount |

Enter the amount that you wish to apply to the transaction. |

|

Process |

Check the box to select the charges that you wish to process. |

|

Process |

Displays True if the charges are applied and processed. |

|

Checkbox |

Displays the following values while editing the charges:

|

|

Is Edited |

Displays True if the Process Amount is modified while editing the charges. |

|

Total Rows |

Specifies the total number of records available in this page. |

User can view only the charge codes whose frequency is Manual and Charge Type is Value/Disbursement/Credit Line; and whose frequency is One-Time and Charge Type is Value/Disbursement/Credit Line/Loan.

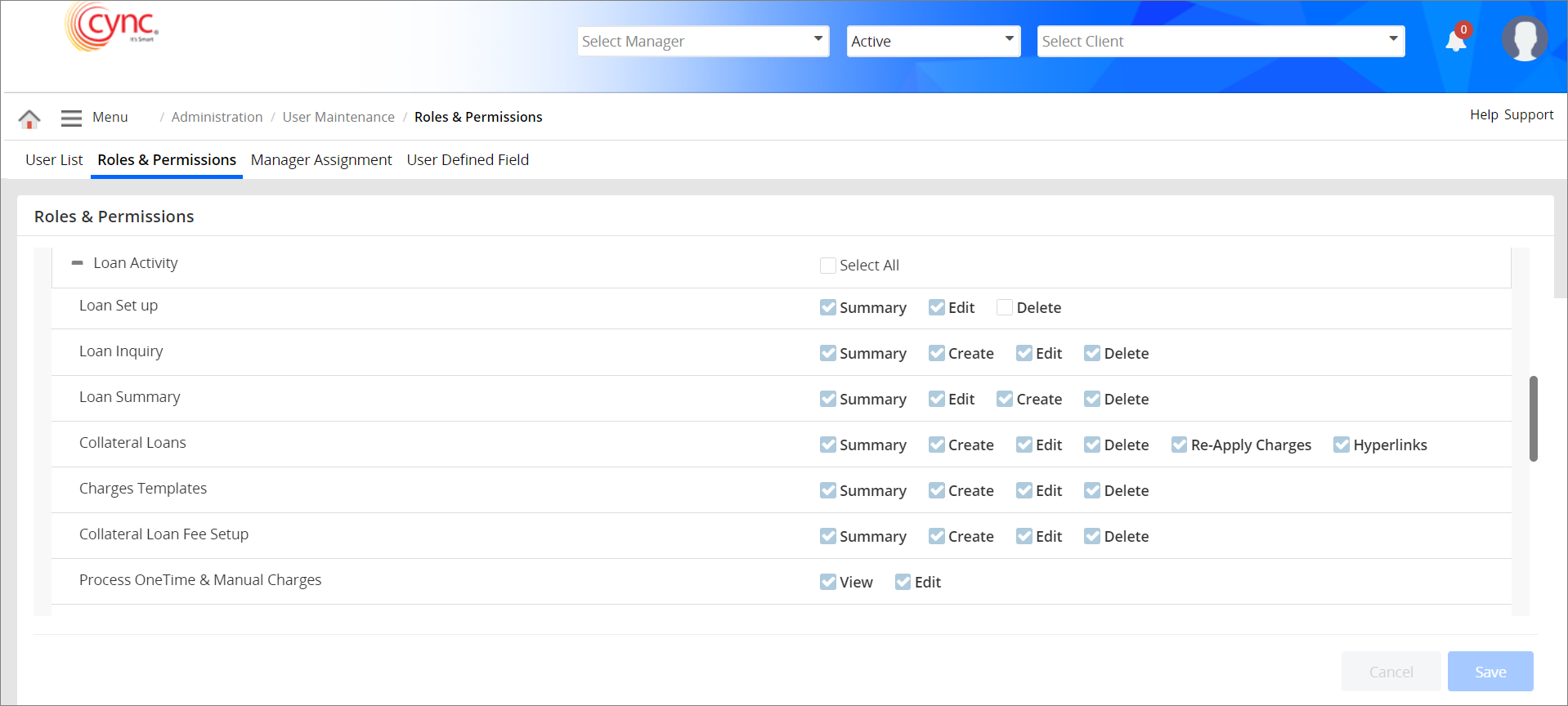

The Process One time and Manual Charges can be viewed and edited based on the settings done under Roles and PermissionsRoles and Permissions page.

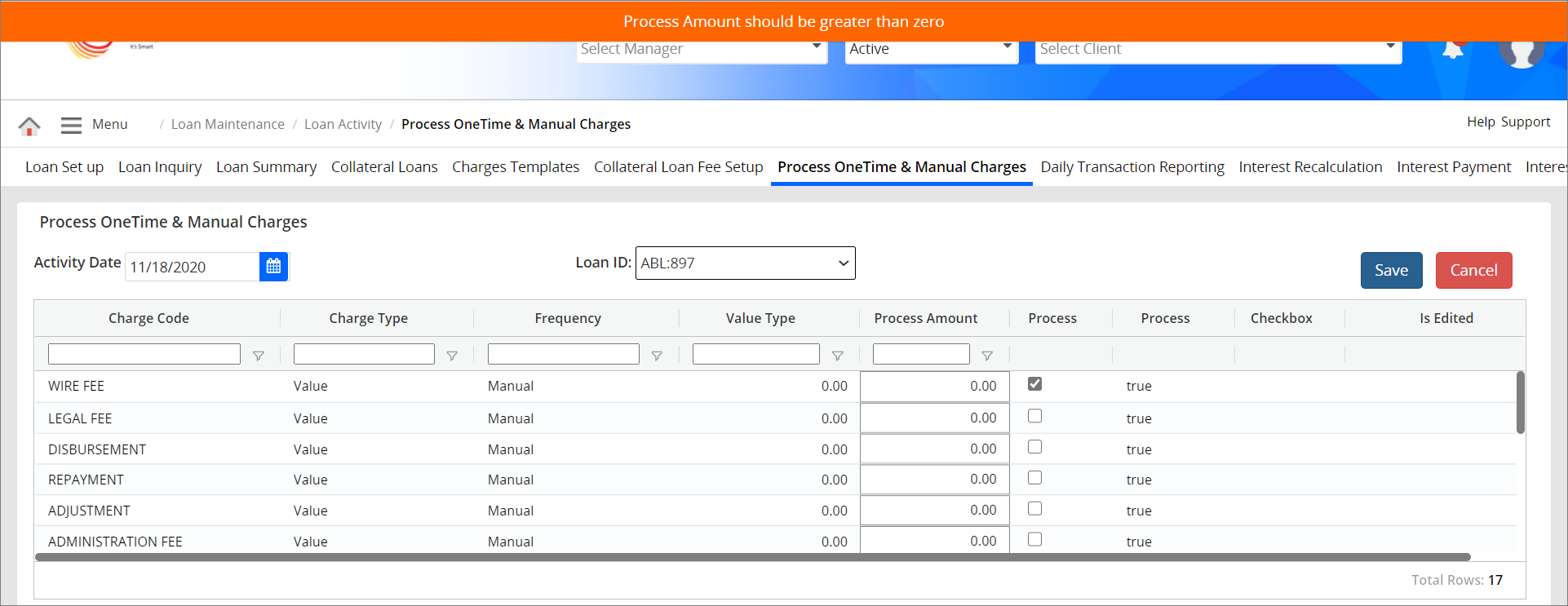

To add a manual or one-time charge, perform these steps:

1. In the Loan ID field, Select Loan ID that you want to process, from drop-down list. The drop-down includes both ABL and Non-ABL loans. The default Loan ID would be ABL loan.

2. Click the  button.

button.

3. In the Activity Date field, select the Activity date.

The default Activity Date would be the current date. You can modify the activity date to any back date. The Activity Date cannot be modified to any future date.

The default Activity Date would be the current date. You can modify the activity date to any back date. The Activity Date cannot be modified to any future date.

4. In the Process Amount field, enter the process amount value. This field is mandatory.

The Process Amount should be greater than zero.

The Process Amount should be greater than zero.

5. Select the Process checkbox. This field is mandatory.

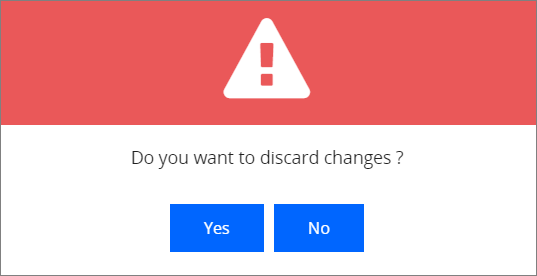

6. Click the ![]() button if you want to cancel applying the manual or one-time charges. A pop-up window appears. Refer to the screenshotRefer to the screenshot (or)

button if you want to cancel applying the manual or one-time charges. A pop-up window appears. Refer to the screenshotRefer to the screenshot (or)

a. Click

to cancel applying the manual or one-time charges. (or)

to cancel applying the manual or one-time charges. (or)

b. Click

to continue applying the manual or one-time charges.

to continue applying the manual or one-time charges.

7. Click the ![]() button. The manual and one-time charges are applied successfully and a success message “Charges are applied successfully” appears.

button. The manual and one-time charges are applied successfully and a success message “Charges are applied successfully” appears.

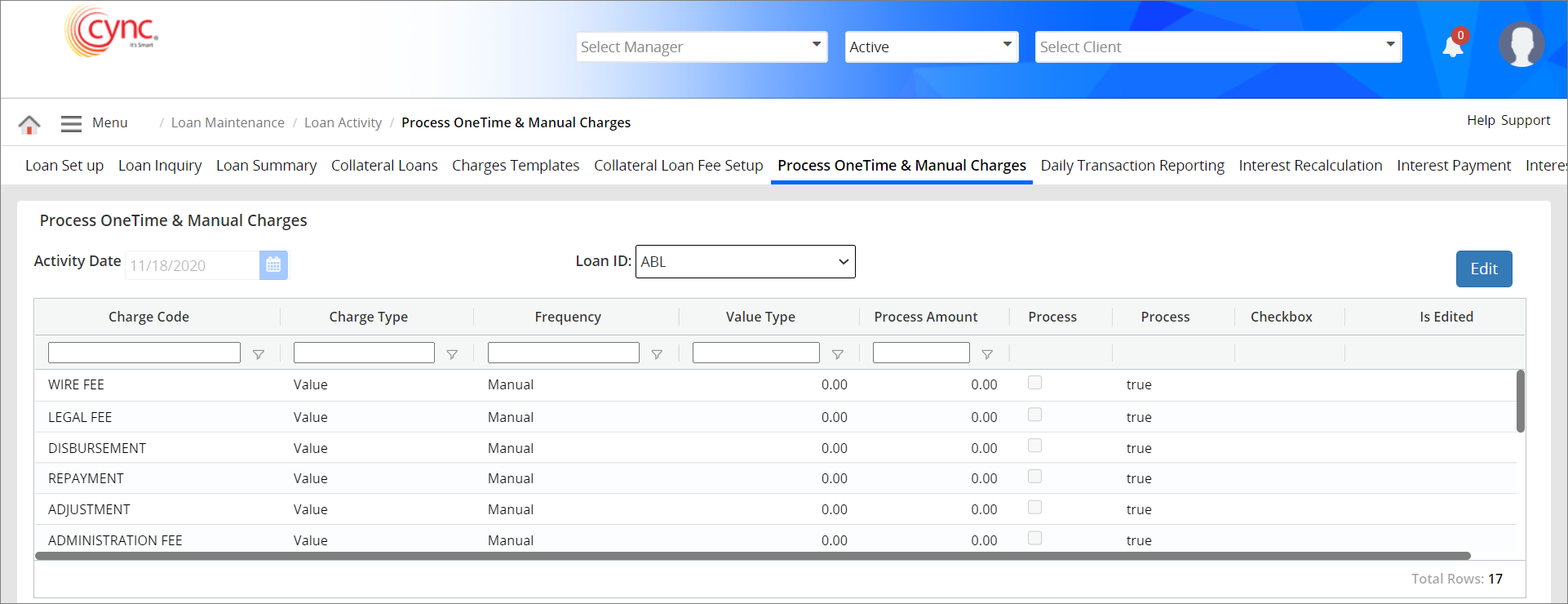

Refer to the screenshot:

The processed charge will be displayed under Collateral Loans page for ABL and NON ABL Loans. The Values will be displayed/updated in the respective fields as per the Charge Code details under Collateral Loans page for ABL and NON ABL Loans. The charges cannot be applied and processed for the Inactive Non-ABL loans.

The Process Amount is calculated as follows,

Process amount for Manual/Onetime Charge Code for ABL Loan = Value * Credit line amount of the client/Disbursement/loan

Process amount for Manual/Onetime Charge Code for non-ABL Loan = Value * Credit line of particular loan Id/Disbursement/loan

If the Process Amount is zero or lesser than zero, then the system shows an error notification.

Refer to the screenshot:

If the checkbox under the Process column is not selected while applying the charges, then the system shows an error notification.

Refer to the screenshot: