Menu / Loan Servicing / Loan Activity / Collateral Loans

Collateral Loans

The loans which are approved in ABL process are displayed under collateral loans. The users can manually create, edit, delete, and export the collateral loan records in the application.

Navigation: Menu → Loan Servicing → Loan Activity → Collateral Loans

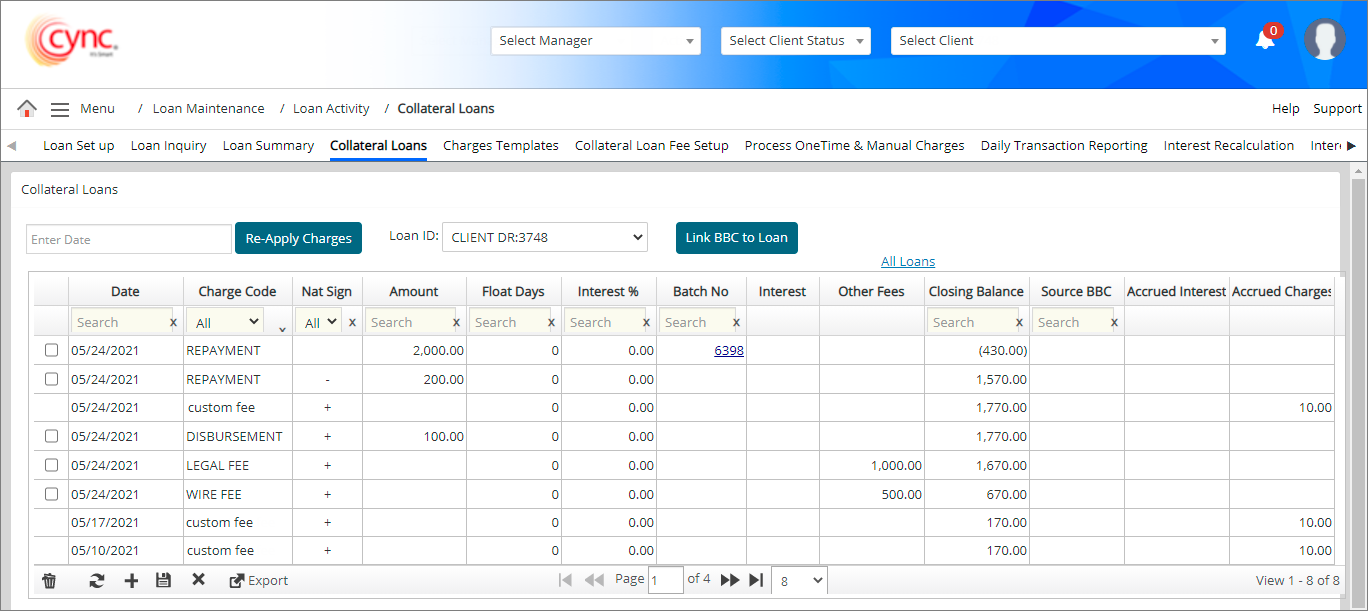

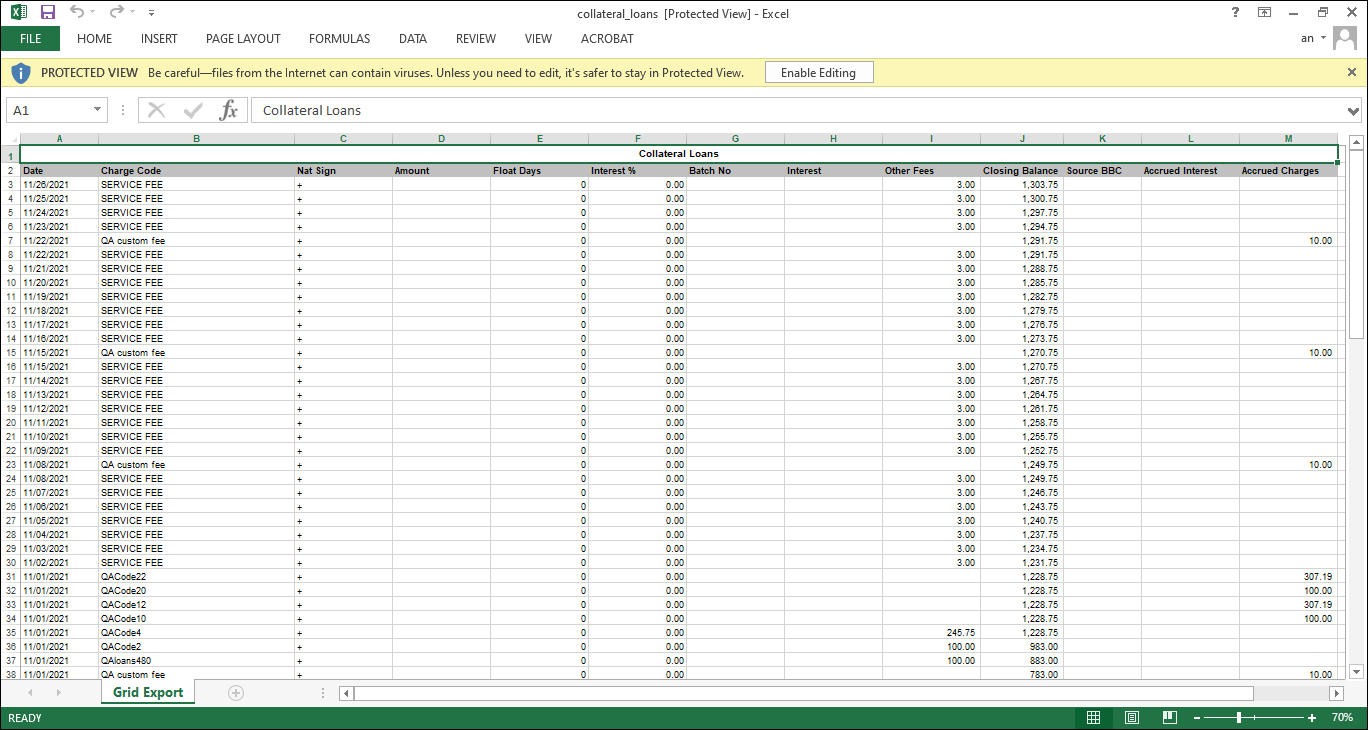

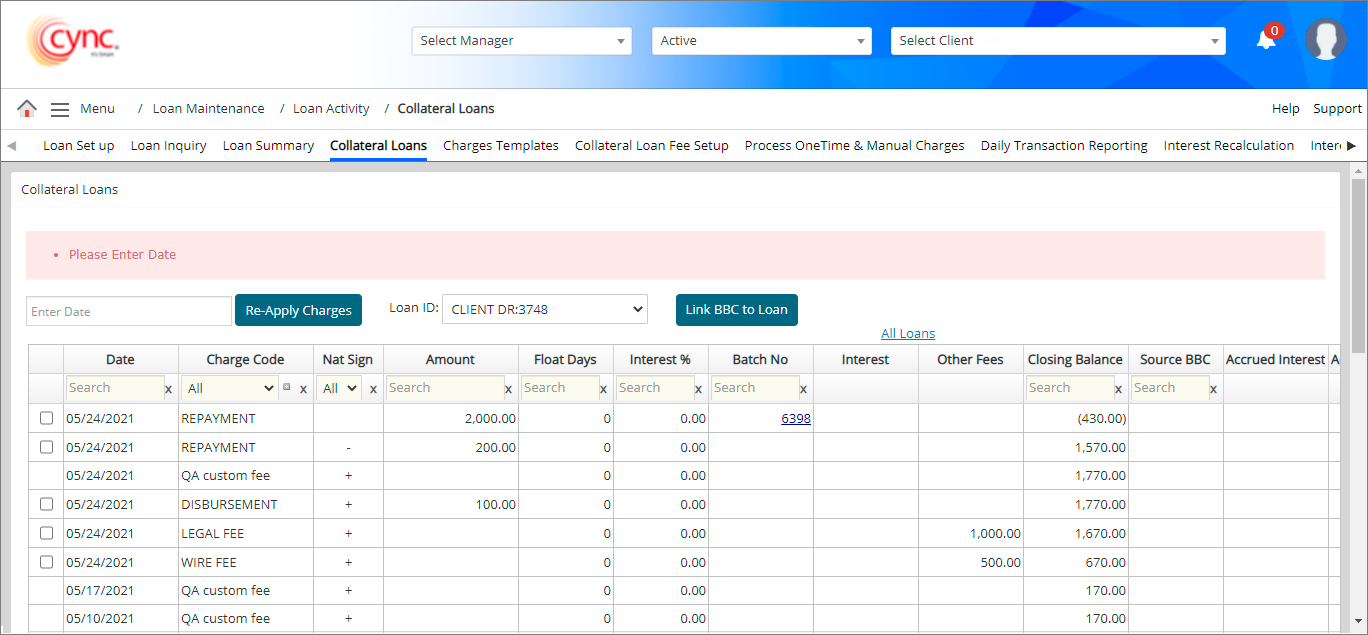

Refer to the screenshot:

Fields and Descriptions

|

Fields |

Descriptions |

|

Date |

Specifies the transaction date. |

|

Charge Code |

Specifies the name given to each charge fee that was created under Administration. |

| Nat Sign |

Specifies the nat sign symbol such as Plus (+) or minus (-).

If user updates the Nat Sign in Charge Templates page for any specific charge code, the Nat Sign will get updated accordingly in Collateral Loans page after recalculating the specific loan or reapplying the charges. |

|

Amount |

Specifies the transaction amount. The same can be viewed under Collateral Loans and Interest Payment page. Hover the mouse under this column to view the tool tip with the details of the payment. |

|

Float Days |

Specifies the number of float days that was set up for that transaction type if applicable. Total Float Days = Float Days of the Source Code + Non-business days between the float posting days. Float Charges is calculated only when the Charge Type is Loan.

|

|

Interest % |

Specifies the interest rate percentage for the loan. |

|

Interest |

Specifies the interest amount for the loan. |

|

Batch No |

Specifies the batch number for repayment charge code. |

|

Other Fees |

Specifies the other fees charged for the loan. |

|

Closing Balance |

Specifies the total outstanding loan balance. Displays the total outstanding balance after each transaction. This outstanding balance of the recent transaction date is displayed as Current Balance under Basic Client Details page. |

|

Source BBC |

Specifies the BBC date that the transaction is tied to. |

|

Accrued Interest |

Specifies the interest amount for the accrued fee. |

|

Accrued Charge |

Specifies the accrued charge fee. |

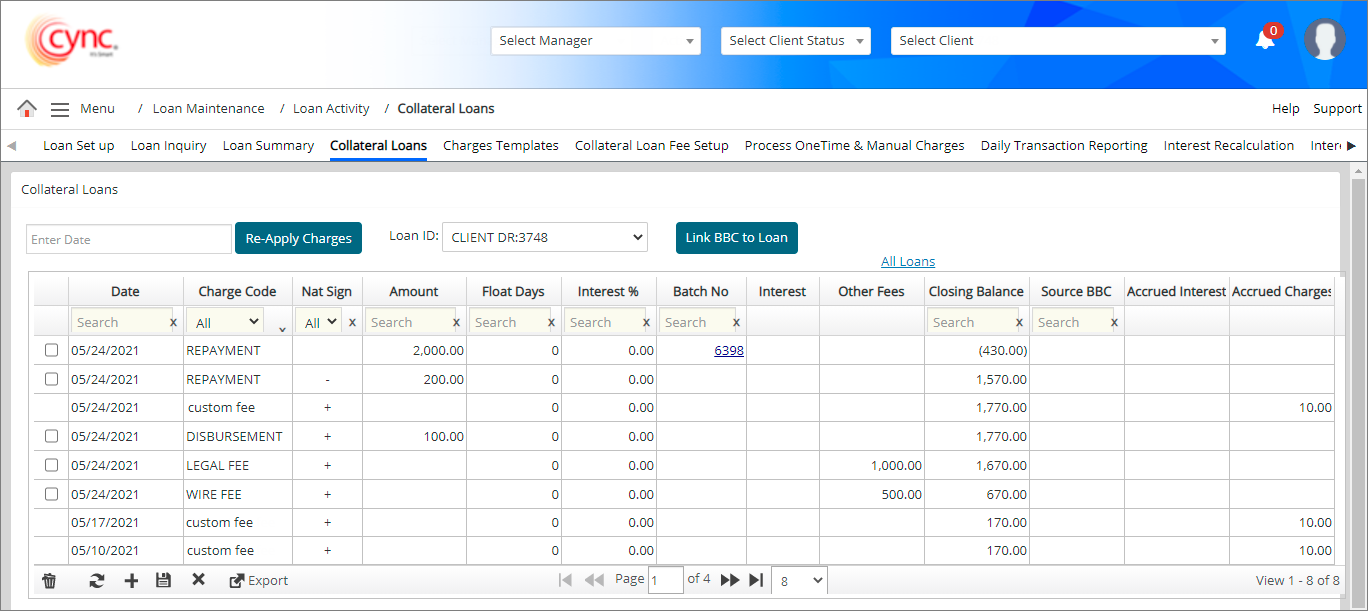

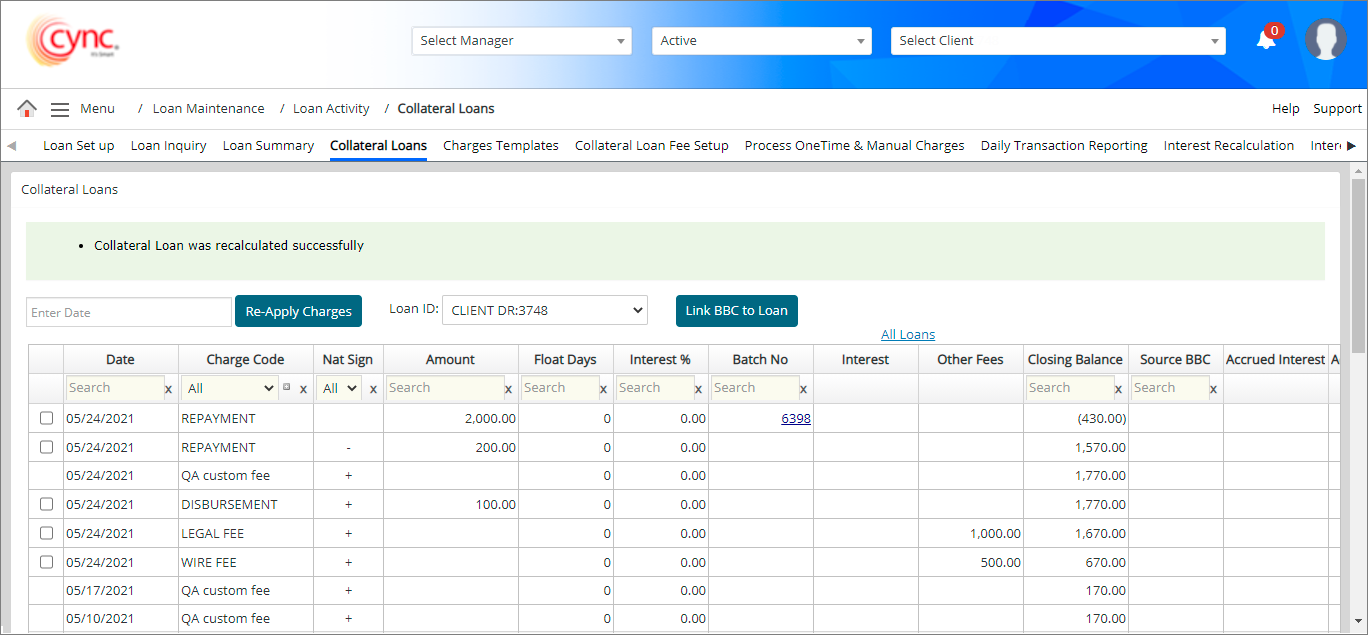

To create collateral loan data, perform these steps:

1. In Loan ID field, select the loan ID from drop-down list. The system displays the list of collateral loan data associated with the selected loan ID.

2. Click  icon to create new collateral loan data under the selected loan ID.

icon to create new collateral loan data under the selected loan ID.

3. In the Date field, select the date for transaction.

4. In the Charge Code field, select the charge code from drop-down list.

5. In the Amount field, enter the loan amount.

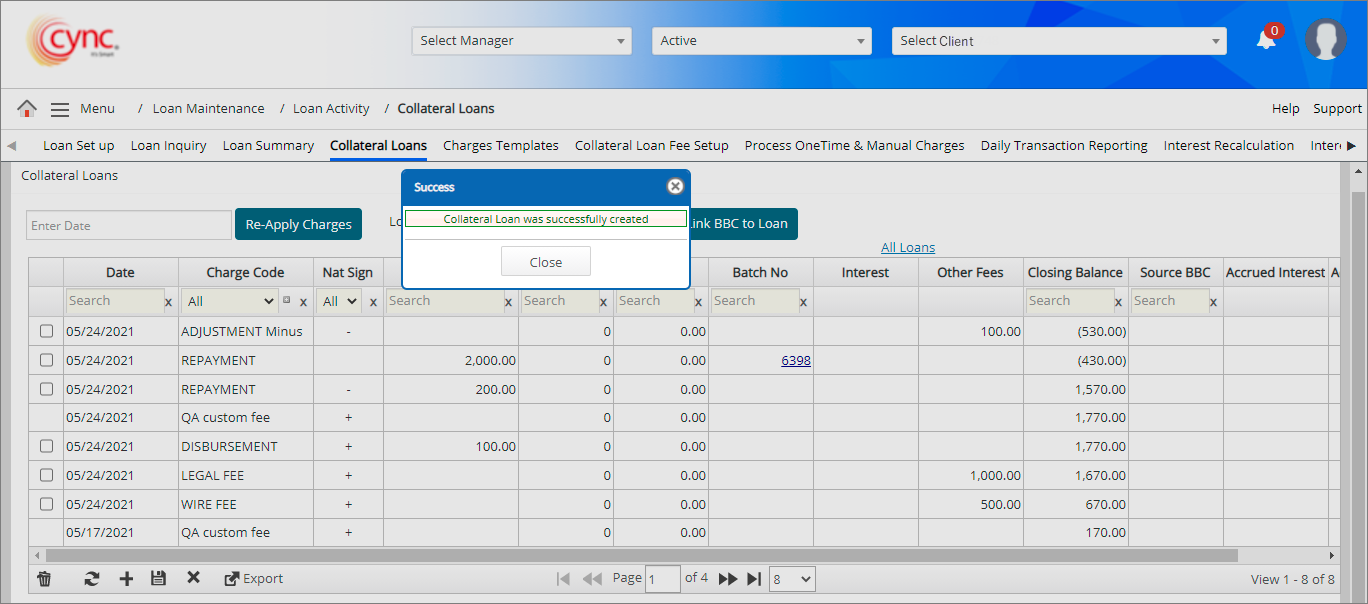

6. Click ![]() . The Collateral Loan data is created and a success message “Collateral Loan was successfully created” appears.

. The Collateral Loan data is created and a success message “Collateral Loan was successfully created” appears.

Refer to the screenshot:

![]() The system will also display the collateral loan data with zero value of amount added via manual entry and collateral file uploads for both ABL and Non-ABL loans.

The system will also display the collateral loan data with zero value of amount added via manual entry and collateral file uploads for both ABL and Non-ABL loans.

Upon creating new collateral loan data, the system logged the collateral loan creation details in Audit Log page.

The balances in the collateral loans page will be updated when a repayment is done based on the combination of Nat sign of charge code and sign of value input by the user.

If the Statement Balance Before Loan Balance is enabled under Basic Parameters page:

If the Statement Balance Before Loan Balance is disabled under Basic Parameters page: there will not be any separate columns for Fee Balance and Interest Balance; and the Closing Balance will be updated based on the combination of Nat Sign of the Charge Code and the sign on user input value.

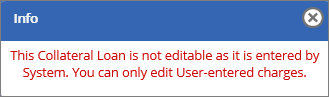

To edit the Collateral loan data, perform these steps:

1. In Loan ID field, select the loan id from drop-down list. The system displays the list of collateral loan data associated with the selected loan ID.

2. Double-click on the collateral loan data row that you wish to edit the data.

3. Edit fields as required.

You can edit only manually entered collateral loan data by the user. If user tries to edit the system-generated collateral loans, then the system shows an error notification.

You can edit only manually entered collateral loan data by the user. If user tries to edit the system-generated collateral loans, then the system shows an error notification.

Refer to the screenshot:

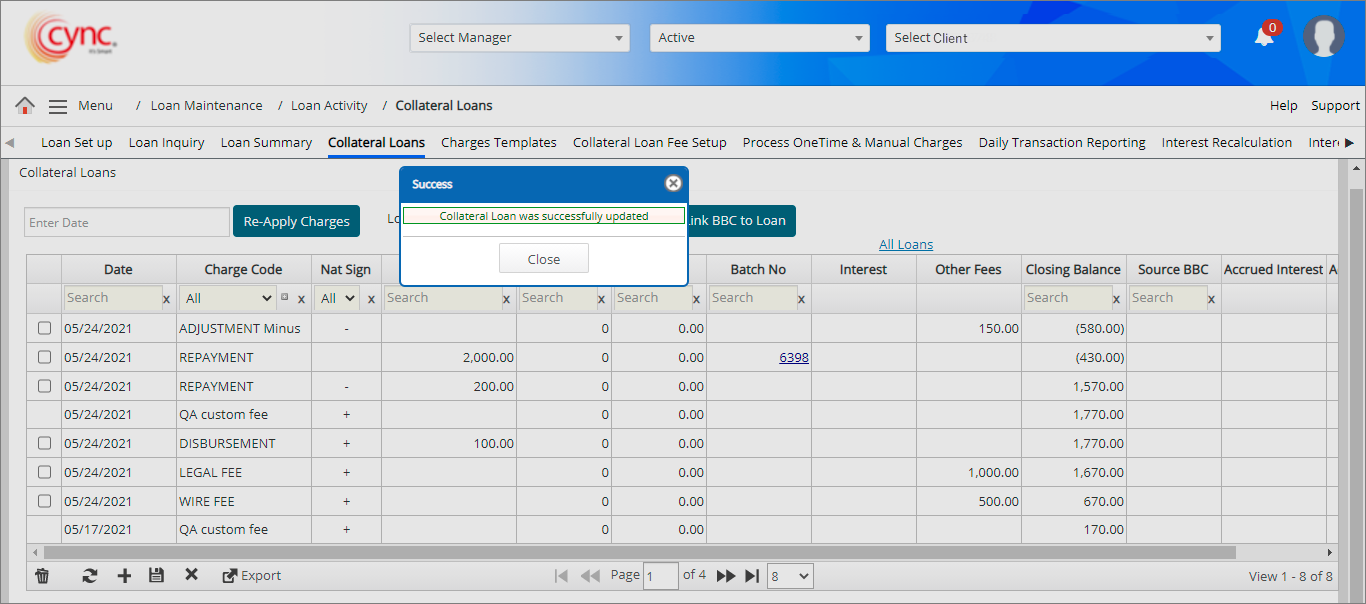

4. Click the ![]() button. The collateral loan data was updated and a success message “Collateral Loan was successfully updated” appears.

button. The collateral loan data was updated and a success message “Collateral Loan was successfully updated” appears.

Refer to the screenshot:

Upon editing the existing collateral loan data, the system logged the collateral loan editing details in Audit Log page.

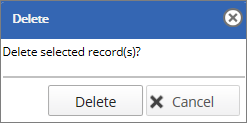

To delete the collateral loan data, perform these steps:

1. In Loan ID field, select the loan id from drop-down list. The system displays the list of collateral loan data associated with the selected loan ID.

2. Select the row of collateral loan data that you wish to delete.

3. Click the ![]() icon. A Delete pop-up window appears.

icon. A Delete pop-up window appears.

Refer to the screenshot:

You can delete only manually entered collateral loan data by the user.

You can delete only manually entered collateral loan data by the user.

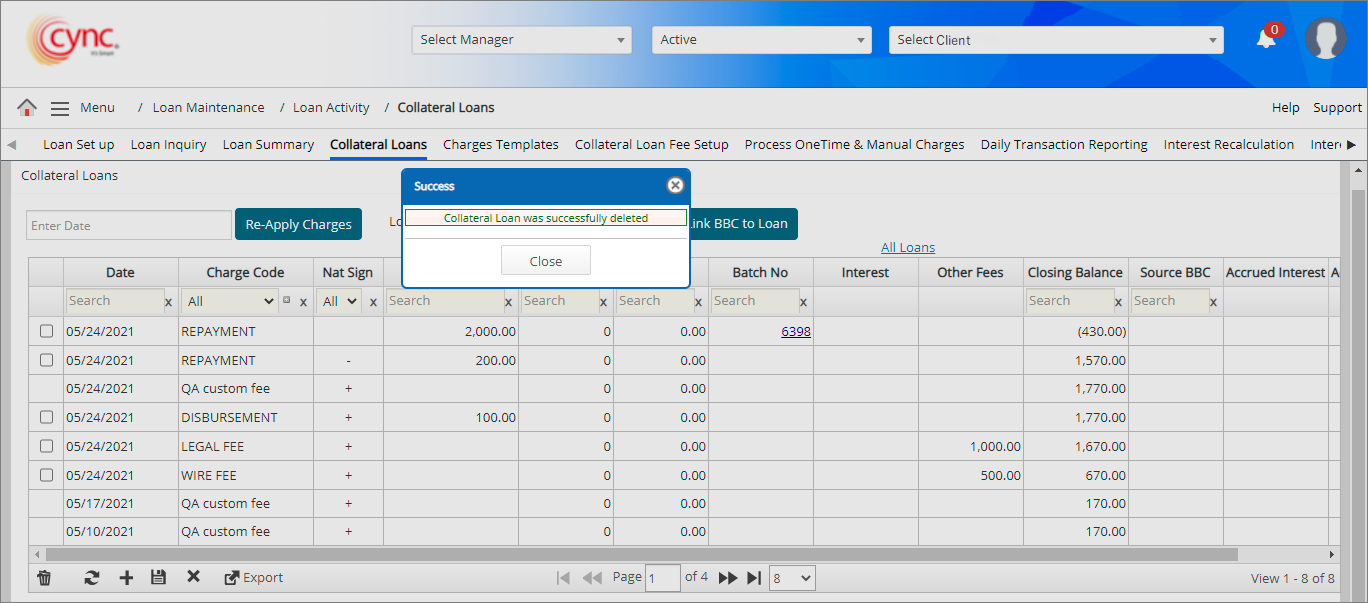

4. Click the ![]() button. The collateral loan data is deleted and success message “Collateral Loan was successfully deleted” appears.

button. The collateral loan data is deleted and success message “Collateral Loan was successfully deleted” appears.

Refer to the screenshot:

The collateral loan data cannot be deleted if the BBC is released. The system will not allow you to delete the collateral loans once the repayment is done via Cash Application. Upon deleting the existing collateral loan data, the system logged the collateral loan deletion details in Audit Log page.

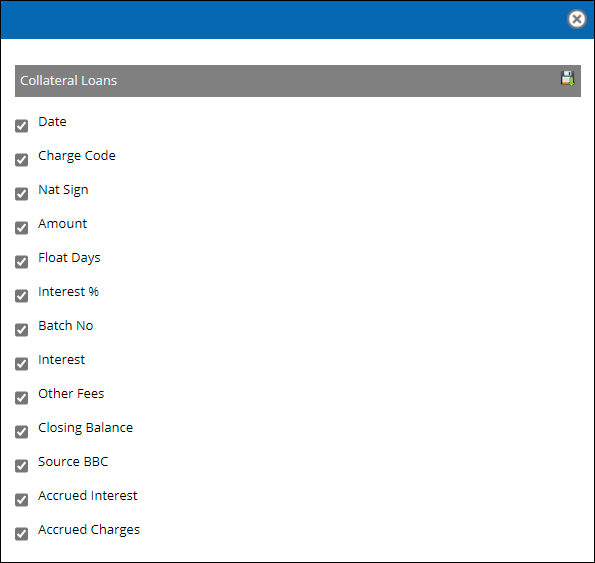

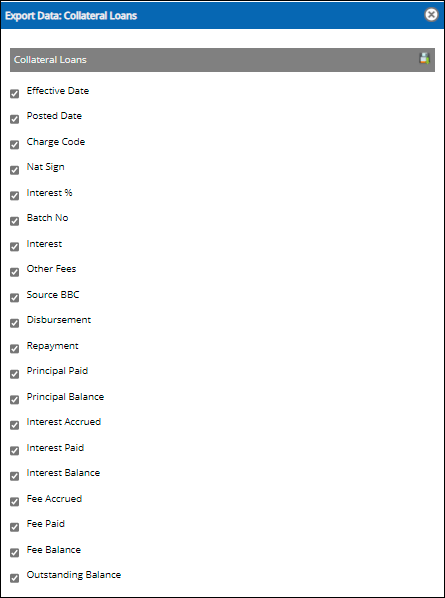

To export the collateral loan data, perform these steps:

1. In Collateral Loans page, click the ![]() button. A pop-up window appears.

button. A pop-up window appears.

Refer to the screenshot:

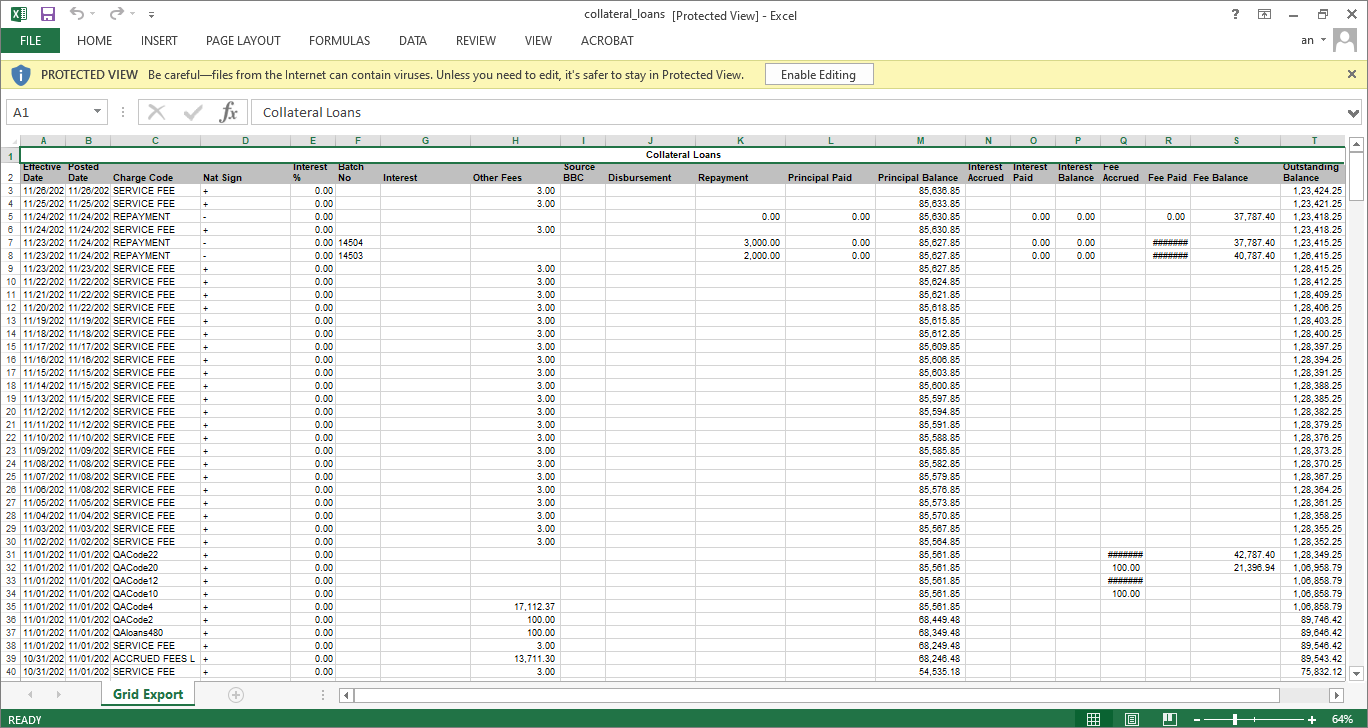

2. Click the ![]() icon to export the Collateral Loan data. The report has been successfully exported in an excel format.

icon to export the Collateral Loan data. The report has been successfully exported in an excel format.

Refer to the screenshot:

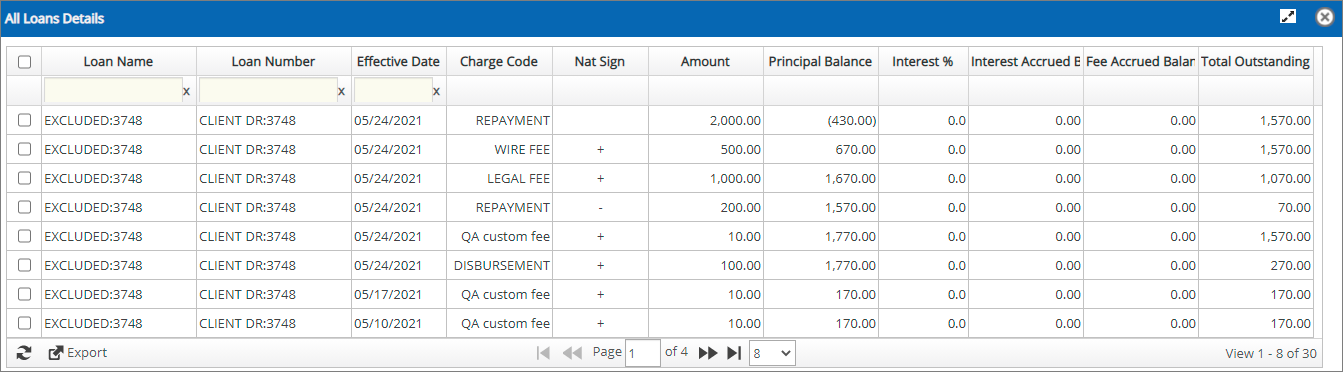

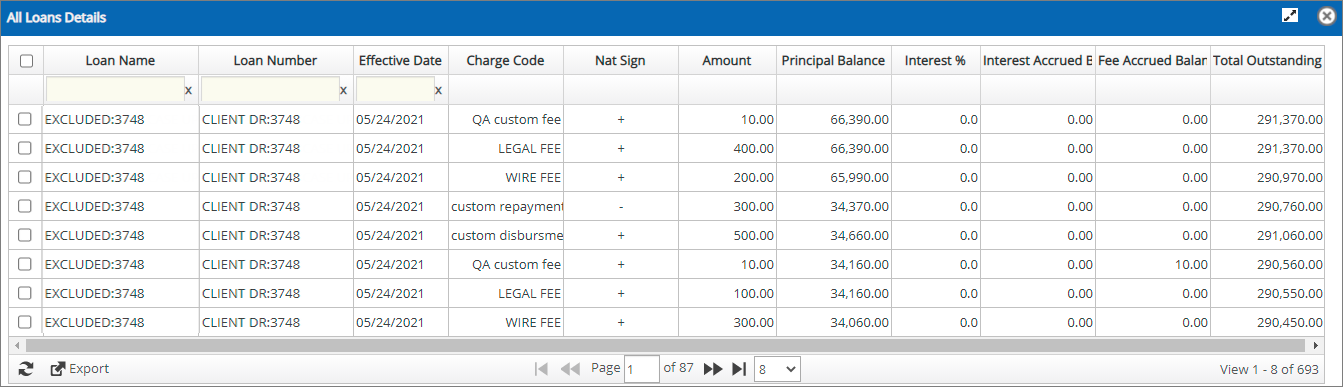

If you click on All Loans link, then the system displays the list of all the loan details related to the specific client in All Loans Details page.

Refer to the screenshot:

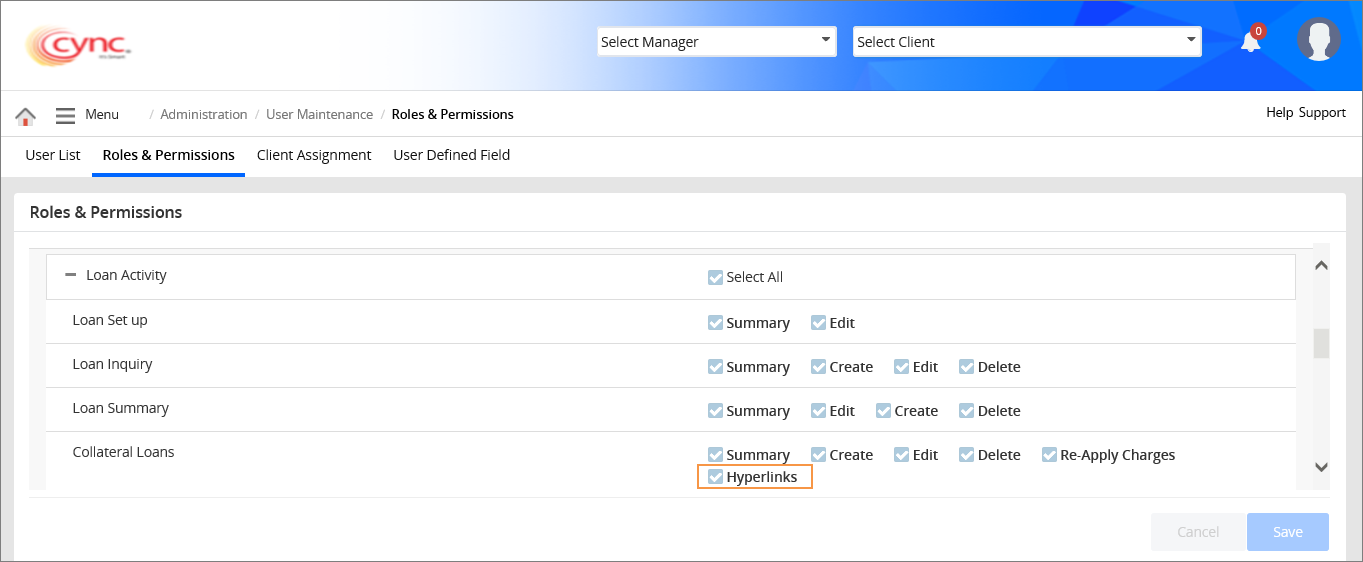

If the Hyperlinks checkbox is ON under the Roles and permissions page, then the system displays the batch number with hyperlinks. If the Hyperlinks checkbox is OFF under the Roles and permissions page, then the system displays the batch number without hyperlinks.

Refer to the screenshot:

When user clicks on the Batch No hyperlink, the system navigates the user to Processed Batch page under Cash Application for the respective ABL/NonABL Loans.

Float Interest: The float interest is calculated based on the system defined float days and Loan Balance. The float interest is calculated and posted in 3 preferences such as; InBalance, Accrue to Loan and, Accrue to Statement. To view the interest calculations with examples for each posting type refer to Interest calculations.pdf

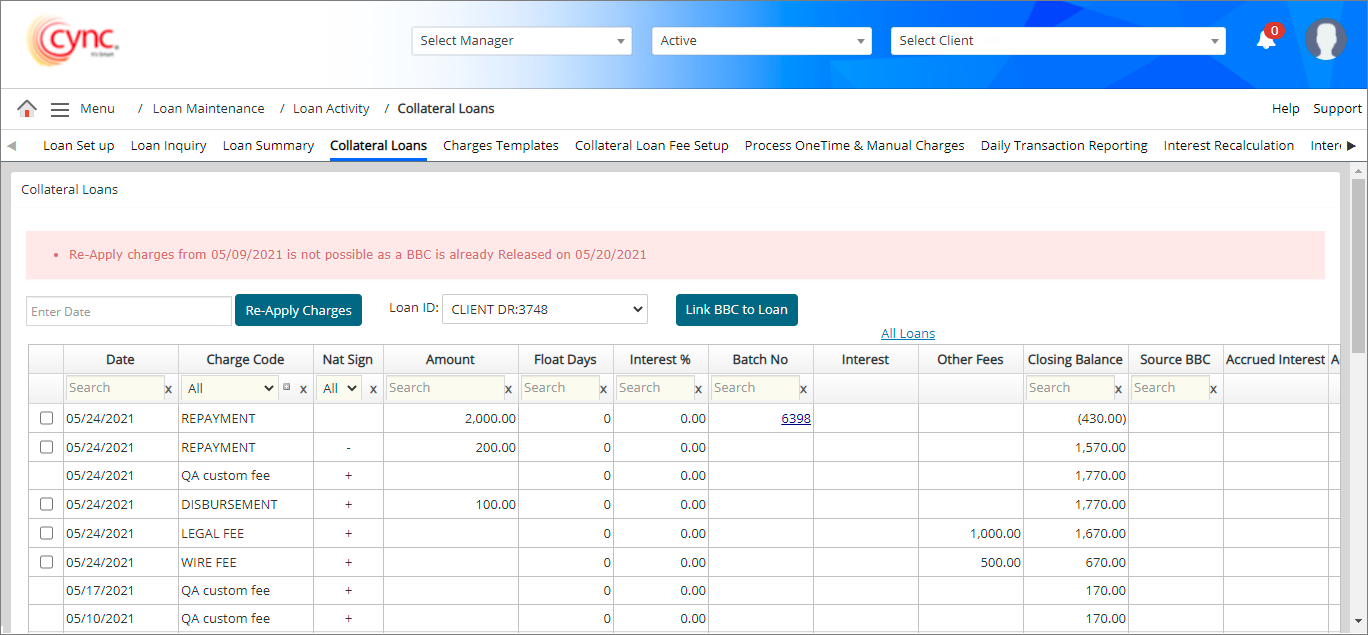

Re-Apply Charges : Allows you to re-apply charges from an earlier date. The charges cannot be re-applied for future date (for both ABL and Non-ABL loans). The backdated charges and fees which may have been missed can be entered here and re-calculate the balance of the loan. However, these transactions cannot be backdated beyond the latest approved BBC. If you need to update charges posted from prior periods, add a ABL Charge Code called ‘BBC Adjustment Fee’ (or similar) in the Charges Template and make the adjustment in that way.

Refer to the screenshot:

If user re-apply the charges without selecting the date in Re-Apply Charges field, then the system shows an error notification.

Refer to the screenshot:

If user selected the date which is lesser than the latest approved BBC date, then the system shows an error notification.

Refer to the screenshot:

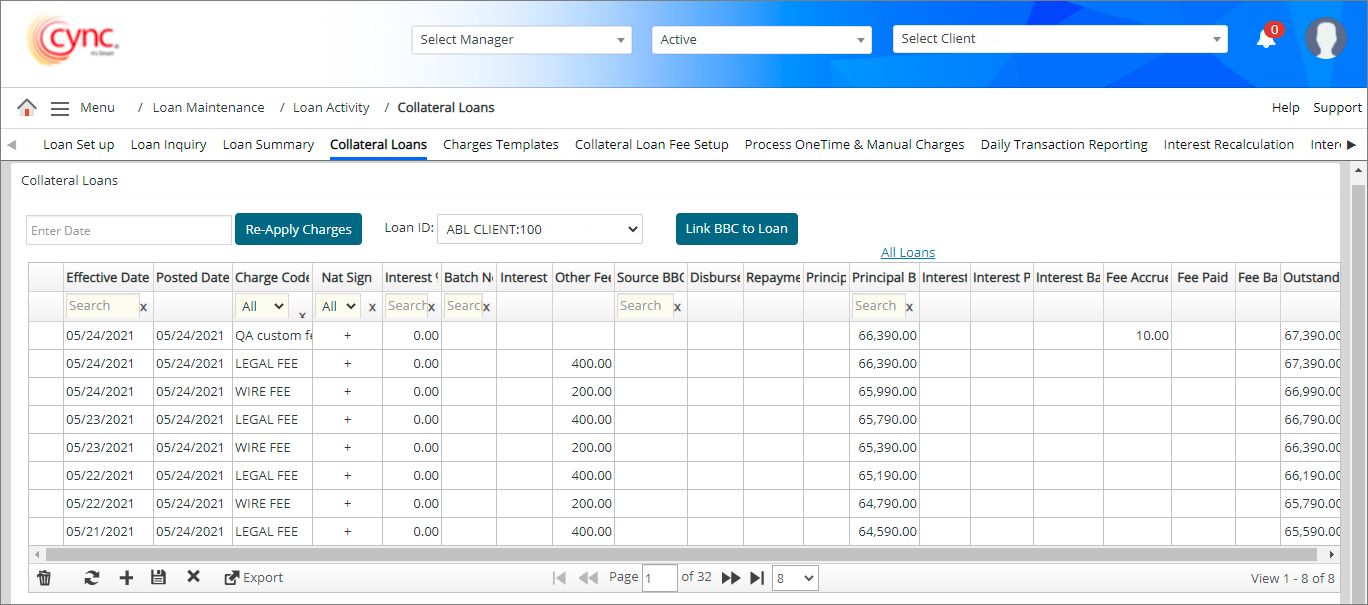

![]() The collateral loans page shows the details based on the preferences. For Accrue to Statement preference, the system shows the accrued fee details.

The collateral loans page shows the details based on the preferences. For Accrue to Statement preference, the system shows the accrued fee details.

Refer to the screenshot:

If you click on All Loans link, then the system displays the list of all the loan details related to the specific client in All Loans Details page.

Refer to the screenshot:

Fields and Descriptions:

|

Fields |

Description |

|

Effective Date |

Specifies the effective date of the transaction. |

|

Posted Date |

Specifies the posted date. |

|

Charge Code |

Specifies the name given to each charge fee that was created under Administration. |

| Nat Sign | Specifies the nat sign symbol such as Plus (+) or minus (-). |

|

Interest |

Specifies the interest. |

|

Batch No |

Specifies the batch number for repayment charge code. |

|

Other fees |

Specifies the other fee if any. |

|

Source BBC |

Specifies the BBC date that the transaction is tied to. |

|

Disbursement |

Specifies the disbursed amount |

|

Repayment |

Specifies the payment amount. |

|

Principal balance |

Specifies the principal balance |

|

Principal paid |

Specifies the paid principal value. |

|

Interest Accrued |

Specifies the accrued interest. |

|

Interest balance |

Specifies the interest balance. |

|

Interest Paid |

Specifies the paid interest value. |

|

Fee Accrued |

Specifies the accrued fee. |

|

Fee balance |

Specifies the accrued fee balance. |

|

Fee Paid |

Specifies the paid accrued fee value. |

|

Outstanding balance |

Specifies the balance amount. |

On clicking the ![]() button, a pop-up window appears.

button, a pop-up window appears.

Refer to the screenshot:

You can click on ![]() icon to export the Collateral Loan data in an excel format.

icon to export the Collateral Loan data in an excel format.

Refer to the Screenshot:

For more information related to Accrue to Statement preference refer to Accrue to Statement.pdf

For more information related to Accrue to Statement preference refer to Accrue to Statement.pdf

The Source BBC date gets updated based on the repayment done through batch process via Cash Application. For more information, please refer to ExampleExample scenario.

For example,

If there is an unapproved BBC 1 (Date: 10/02/2019). User made repayments via batches 3290 and 3292 before approving BBC 1 and via batches 3293 and 3294 after approving BBC 1.

If the effective date is after the current BBC i.e. BBC 1 (10/02/2019), then the batches 3293 and 3294 will not have any source BBC date. The value of New Cash Collected in Receivables Rollforward page should get update only for the batch 3290 and 3292.

Repayment with batches (3293 and 3294) are linked to the next BBC (11/02/2019). When user approve the next BBC (11/02/2019), the values of New Cash Collected in Receivables Rollforward page get updated for the current BBC (11/02/2019) with the batch (3293 and 3294).

When user made any repayments with new batch 3295 and effective date is less than the current BBC (11/02/2019), the value of New Cash Collected should get updated for the current BBC with the new batch value. i.e., New Cash Collected value = Batch value of 3293 + Batch value of 3294 + Batch value of 3295.

When user made any repayments with new batch 3300 and effective date is greater than the current BBC (11/02/2019), the transaction of batch 3300 is not linked to any source BBC date so that the value of New Cash Collected will not get update for the current BBC (11/02/2019).

When user change the unapproved BBC 2 date (11/02/2019) greater than after the effective date of batch 3300 transaction under BBC Review Date page, the transaction of batch 3300 gets included in the BBC based on the new BBC date (10/07/2019). Upon modifying the unapproved BCC 2 date with new BBC date, the source BBC date for the transaction batch (3293, 3294, 3295 and 3300) should get update with the new BBC date (10/07/2019). The value of “New Cash Collected” should get update only for the batches (3293, 3294, 3295 and 3300).

Upon modification, the value of New Cash Collected should get update under BBC Availability page, Receivables Rollforward page and BBC Report page.