Note, as a pre-requisite, the charge codes need to be first set up under Menu → ABL → Other General Codes → Charge Codes.

Note, as a pre-requisite, the charge codes need to be first set up under Menu → ABL → Other General Codes → Charge Codes.Menu / Loan Servicing / Loan Activity / Charges Templates

Charges Templates

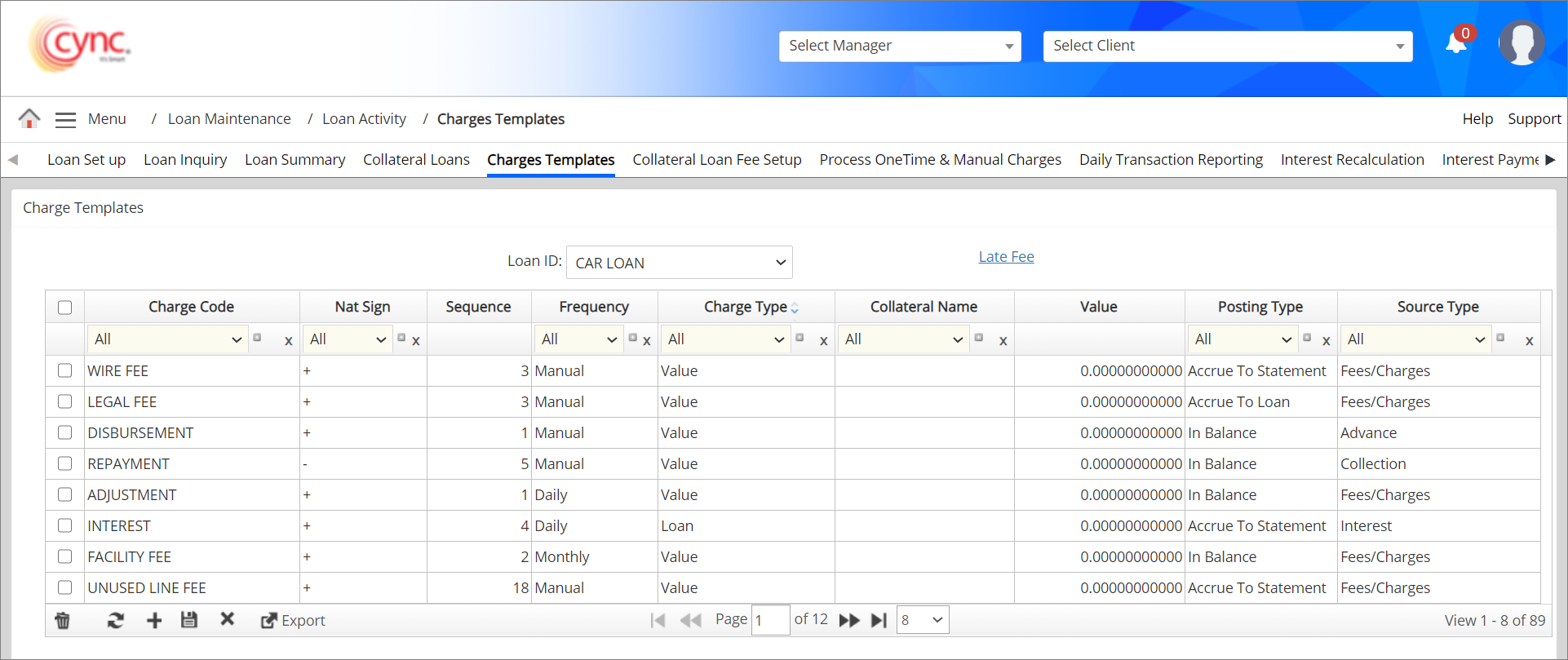

The Charge Templates page allows you to add, update or delete the charges that will apply to each client.

You can also set up how the charge should be applied, for example, add to the loan balance, accrue and post once per month to the loan balance or accrue and issue a charges statement.

Note, as a pre-requisite, the charge codes need to be first set up under Menu → ABL → Other General Codes → Charge Codes.

Note, as a pre-requisite, the charge codes need to be first set up under Menu → ABL → Other General Codes → Charge Codes.

Navigation: Menu → Loan Servicing → Loan Activity → Charges Templates

|

Table of Contents |

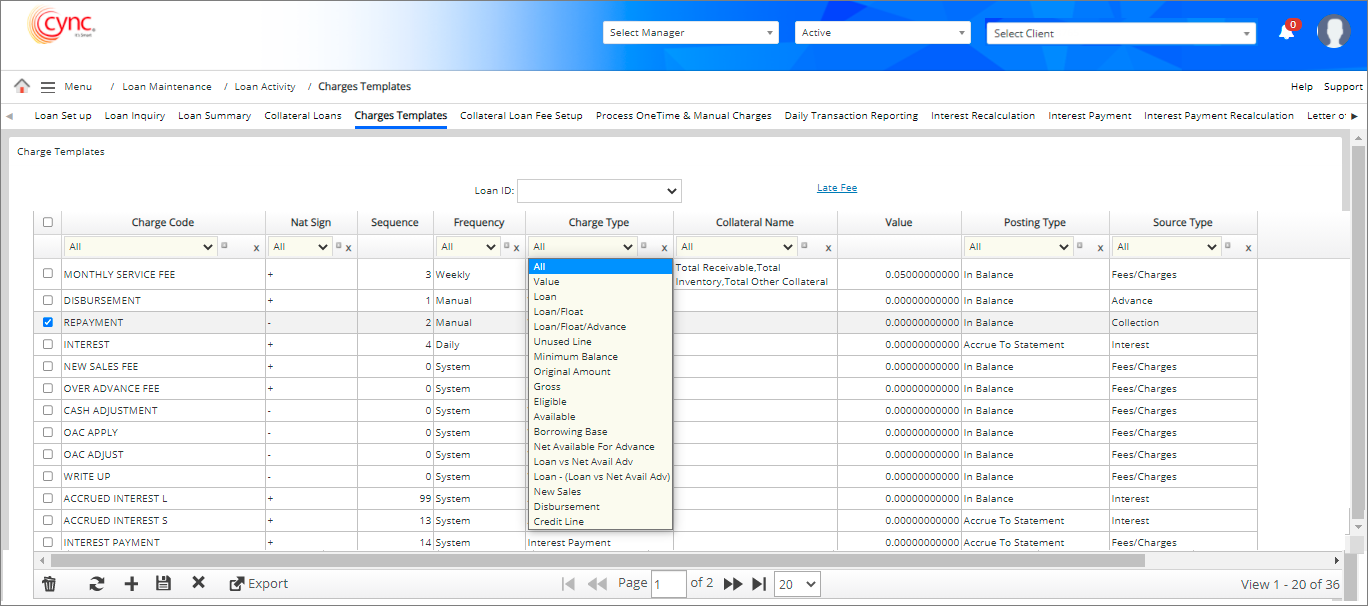

Refer to the screenshot:

Fields and Descriptions

|

Fields |

Descriptions |

|

Loan ID |

Allows user to select the Loan ID from the drop-down list. |

|

Charge Code |

Specifies that charge to be applied. |

|

Nat Sign |

Specifies the action to take when calculating the charge. For example, cash applied will reduce the loan balance (-) while funding will increase the loan balance (+). |

|

Sequence |

Specifies the sequence or order in which the charges should be calculated. |

|

Frequency |

Specifies the frequency for applying the charge (i.e. Annually, Bus. Daily, Daily, Monthly,Quarterly, Weekly, One Time, System or Manual).

|

|

Charge Type |

Specifies how the charge will be calculated, e.g., on the loan balance, unused line or a specific value that you must enter. |

|

Collateral Name |

Specifies the collateral name for a particular charge type. It includes a list of collateral types. You can search for each collateral name. |

|

Value |

If “Value” was selected as the Charge Type then you must enter the value that will be used when calculating the charge. |

|

Posting Type |

Specifies the posting type for the specific charge code. It includes the following:

|

|

Source Type |

Specifies the source type of the charge code. It includes the following:

|

To create a new charge code, perform these steps:

1. In the Loan ID field, select the loan ID from the drop-down list.

2. Click the  button.

button.

3. In the Charge Code field, select the charge code type from the drop-down list.

Once you select the charge code, the system auto-populates the values in Nat Sign, Sequence, Frequency, Charge Type, Value, Posting Type and Source Type fields for the respective charge code as defined in the Charge Codes page for both ABL and MCL loans. You can also modify the field values if required.

Once you select the charge code, the system auto-populates the values in Nat Sign, Sequence, Frequency, Charge Type, Value, Posting Type and Source Type fields for the respective charge code as defined in the Charge Codes page for both ABL and MCL loans. You can also modify the field values if required.

4. In the Nat Sign, Sequence, Frequency, and Charge Type fields, provide the required values.

5. In the Collateral Name field, select the collateral name from the drop-down list.

6. In the Value field, enter the value.

7. In the Posting Type field, select the posting type from the drop-down list.

8. In the Source Type field, select the source type from the drop-down list.

9. Click the ![]() button. The charge template is created and saved.

button. The charge template is created and saved.

Once the charge code is applied in Collateral Loans, NAT Sign, Source Type, and Posting Type of the applied Charge code cannot be edited.

Once the charge code is applied in Collateral Loans, NAT Sign, Source Type, and Posting Type of the applied Charge code cannot be edited.

The system does not allow editing NAT Sign, Source Type, and Posting Type of that Charge code on the Charges Templates page.

Upon creating new charge codes, the system logged the charge code creation details on the Audit Log page.

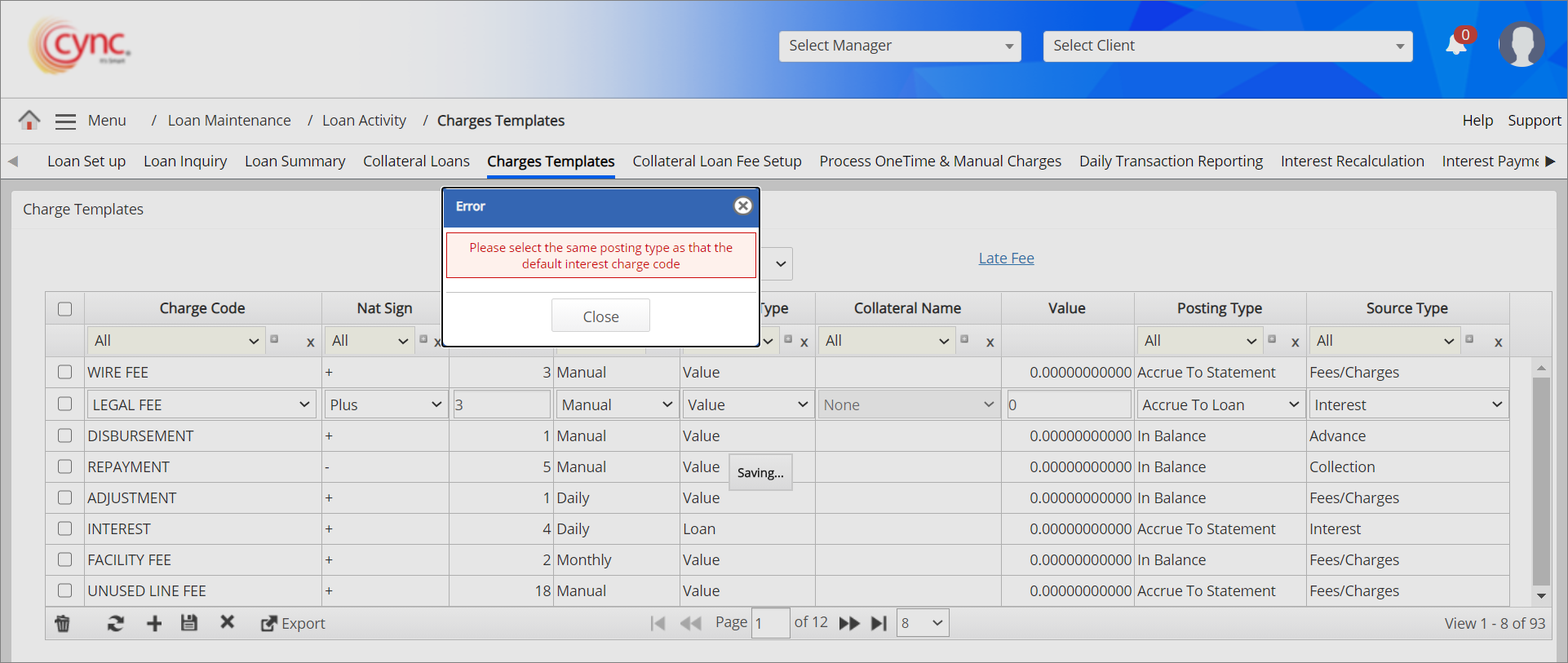

If the posting type of custom INTEREST charge code is not same as the posting type of standard INTEREST charge code while creating/editing the charge code in Charge Templates page, then the system shows an error notification.

Refer to the screenshot:

The posting type of standard INTEREST charge code can be set under Charge Codes page.

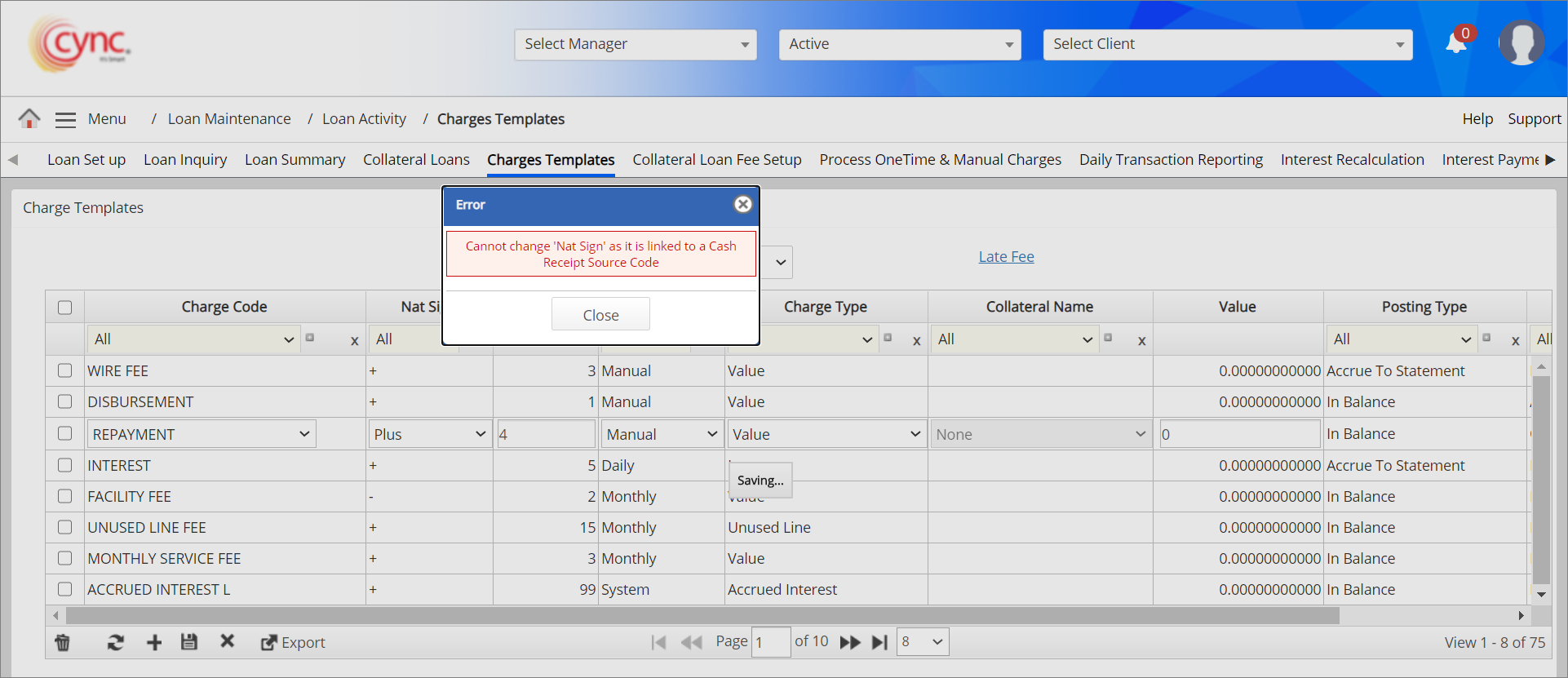

If user tries to change and save the Nat sign of the Charge Code which was already associated with the Cash Receipts Source Code, then the system shows an error notification.

Refer to the screenshot:

To edit a charge code:

1. In the Loan ID field, select the loan ID from the drop-down list.

2. Double-click on the charge code field you want to edit.

3. Change the value of the charge code or enter a value.

4. Click the ![]() button. The charge template is updated and a success message "Charge Template was successfully updated" appears.

button. The charge template is updated and a success message "Charge Template was successfully updated" appears.

Upon editing the existing charge codes, the system logged the charge code editing details on the Audit Logs page.

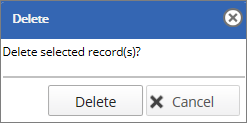

To delete a charge code, perform these steps:

1. In the Loan ID field, select the loan ID from the drop-down list.

2. Select the row of charge code that you wish to delete.

3. Click the ![]() icon. A Delete pop-up window appears.

icon. A Delete pop-up window appears.

Refer to the screenshot:

4. Click the ![]() button. The charge template is deleted and a success message “Charge Template was successfully deleted” appears.

button. The charge template is deleted and a success message “Charge Template was successfully deleted” appears.

![]() The charge cannot be deleted if it has already been used in Collateral Loans. Upon deleting the existing charge codes, the system logged the charge code deletion details on the Audit Logs page.

The charge cannot be deleted if it has already been used in Collateral Loans. Upon deleting the existing charge codes, the system logged the charge code deletion details on the Audit Logs page.

Accrue to Loan - Once the repayment is made and the closing balance is reduced to zero, then float interest is calculated based on the defined float days.

Once the excess payment is made and the closing balance appears negative, then float interest is calculated based on the outstanding balance of the repayment date and based on defined float days.

Charge types include the following:

For example, Consider the Charge Code as Legal Fee, Charge Type: Gross, Collateral Name: Receivables 1 (Gross Receivables: $100,000.00) and Value: 0.100000 (this is considered as a percentage), then the Legal fee is calculated as $100,000.00 * 0.100000% = $100.00.

1. Value: If the selected charge type is Value, then the fees are calculated based on the value rate.

2. Loan: If the selected charge type is Loan, then the fees are calculated based on the outstanding loan value.

3. Loan / Float: If the selected charge type is Loan / Float, then the interest is calculated based on the total of interest applied to the outstanding loan value and the float amount.

4. Loan / Float / Advance: If the selected charge type is Loan / Float / Advance, then the interest is calculated based on the loan amount, float amount and advance rate.

5. Minimum Balance: If the selected charge type is Minimum balance, then the fees are calculated based on the balance.

6. Original Amount: If the selected charge type is Original amount, then the fees are calculated based on the original amount.

7. Gross: If the selected charge type is Gross, then the fees are calculated based on the gross value.

8. Eligible: If the selected charge type is Eligible, then the fees are calculated based on the eligible amount.

9. Available: If the selected charge type is Available, then the fees are calculated based on the available amount.

10. Borrowing Base: If the selected charge type is Borrowing Base, then the fees are calculated based on the borrowing base value.

11. Net Available for Advance: If the selected charge type is Net Available for Advance, then the fees are calculated based on the net available for advance value.

12. Loan vs Net Avail Advance: If the selected charge type is Loan vs Net Avail Advance, then the particular charge code amount will be calculated based on the condition IF(Closing Balance - Net Total Available for Advance > 0, TRUE Net Total Available for Advance, FALSE Closing Balance) * Value.

![]() 'Loan Balance is Positive' condition can be applied for the latest approved BBC. For this condition, the Net Available for Advance is calculated by considering the Net Total Available for Advance value as given in the BBC Availability page.

'Loan Balance is Positive' condition can be applied for the latest approved BBC. For this condition, the Net Available for Advance is calculated by considering the Net Total Available for Advance value as given in the BBC Availability page.

Loan – (Loan vs Net Avail Advance): If the selected charge type is Loan – (Loan vs Net Avail Advance), then the particular charge code amount will be calculated based on the condition (Closing Balance - IF(Closing Balance - Net Total Available for Advance > 0, TRUE Net Total Available for Advance, FALSE Closing Balance)) * Value.

'Loan Balance is Negative or Zero' condition is applied for the latest approved BBC. For this condition, the Net Available for Advance is calculated by considering the Net Total Available for Advance value as given in the BBC Availability page.

'Loan Balance is Negative or Zero' condition is applied for the latest approved BBC. For this condition, the Net Available for Advance is calculated by considering the Net Total Available for Advance value as given in the BBC Availability page.

Also, the system calculates the charge amount in the collateral loans based on the following scenarios:

Scenario 1: Loan Balance is Positive (No Approved BBC or Net Available for Advance = 0 for last approved BBC)

For example,

Closing Balance = 50000

Value = 0.000156862750 for Loan vs Net Avail Adv

Value = 0.000266666670 for Loan - (Loan vs Net Avail Adv)

Closing-Net Available > 0 (50000 - 0 = 50000)

Loan vs Net Avail for Adv = Net Available for Adv * Value (0 x 0.000156862750) = 0

Charge Amount = 0

Closing-Net Available > 0 (50000 - 0 = 50000)

Loan-Loan vs Net Available for Adv = (Closing Bal- Net Available for Adv) * Value = 50000 * 0.000266666670 = 13.3333335

Charge Amount =13.3333335

Scenario 2: Loan Balance is Negative or Zero (No Approved BBC or Net Available for Advance = 0 for last approved BBC)

Closing-Net Available < 0

Loan-Loan vs Net Available for Adv = (Closing Bal- Closing Bal) * Value

Closing Balance = -1000

Closing-Net Available < 0

Loan vs Net Available for Adv = Closing Balance * Value = (-1000* 0.000156862750)= -0.1568627

Charge Amount = -0.1568627

Closing-Net Available < 0

Loan-Loan vs Net Available for Adv = (Closing Balance - Closing Balance ) * Value (-1000 - -1000 ) = 0 * 0.000266666670 = 0

Charge Amount =0

The charge amount will not be displayed in the collateral loans if the charge amount is either 0 or negative.

The charge amount will not be displayed in the collateral loans if the charge amount is either 0 or negative.

15. New Sales: If the selected charge type is New Sales, then the system fetches the data from the last approved BBC. The charge is calculated based on the New Sales value available under the BBC Availability page.

16. Disbursement: If the selected charge type is Disbursement, then the particular charge code amount is calculated based on the Disbursement amount.

For example, Consider Charge type as Disbursement for WIRE FEE.

Value = 0.02 (This is considerable a percentage)

Disbursement Amount = 5000

WIRE FEE = Disbursement Amount * Value (5000 * 0.02) = 100.

The Disbursement option is disabled if the charge codes are selected as Disbursement, Repayment, Interest, Unused Line Fee, and Minimum Loan Balance Charge codes.

The Disbursement option is disabled if the charge codes are selected as Disbursement, Repayment, Interest, Unused Line Fee, and Minimum Loan Balance Charge codes.

If a user edits the fee once the BBC is approved, then the fee amount is updated based on the latest disbursement amount only after approval of the next BBC. The updated fee details are displayed on the Collateral Loan page, BBC Availability page, BBC Trend Report page, and Collateral Analysis - Comparative Report page.

17. Credit Line: If the selected charge type is Credit Line, then the particular charge code amount is calculated based on the Credit Line amount entered on the “Basic Client Detail” page.

For example, Consider Charge type as Credit Line for ADMINISTRATION FEE.

Value = 0.02 (This is considerable as percentage)

Credit Line = 1500000

ADMINISTRATION FEE = Credit Line * Value (1500000*0.02) = 30000.

![]() The credit line is disabled if the charge codes are selected as Disbursement, Repayment, Interest, Unused Line Fee, and the Minimum Loan Balance Charge codes.

The credit line is disabled if the charge codes are selected as Disbursement, Repayment, Interest, Unused Line Fee, and the Minimum Loan Balance Charge codes.

If there is no credit line set under the Basic Client Details page, then the fee should be displayed as 0 on the, Collateral Loans Page.

If a user edits the credit line amount once the BBC is approved, then the fee amount is updated based on the latest credit line amount only after approving the next BBC. The updated fee details are displayed on the Collateral Loan page, BBC Availability page, BBC Trend Report page and Collateral Analysis - Comparative Report page.

Refer to the screenshot:

If the Charge Types selected are Gross/Eligible/Available/Borrowing Base/Net Available for Advance and based on the selected collateral type, the rate available under the Value column is always considered to be %.

If the Charge Types selected are Gross/Eligible/Available/Borrowing Base/Net Available for Advance and based on the selected collateral type, the rate available under the Value column is always considered to be %.

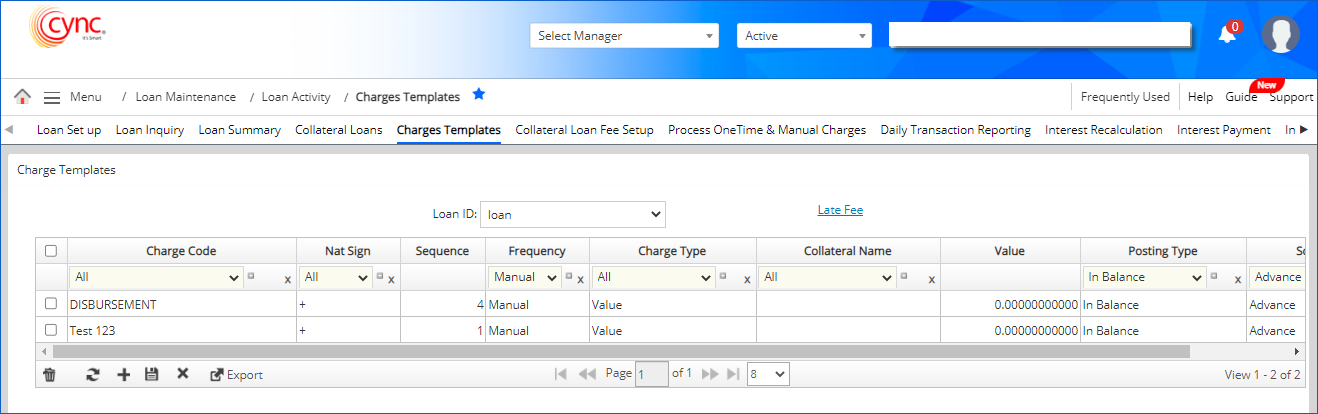

Source Type - Advance

For all the charge codes with the Advance source type, the frequency and posting type are set to Manual and In Balance, respectively. These are non-editable fields.

Refer to the screenshot:

On editing the Disbursement charge code, the Frequency field is not an editable field like Sequence or Charge Type.

When editing any of the charge codes with the Advance source type, the Frequency and Posting type fields are non-editable.

There is no impact on Disbursement or Funding, which is done through Analyst Workflow or BBC Status Page or Through Collateral Loan Upload.

There is no impact on Disbursement or Funding, which is done through Analyst Workflow or BBC Status Page or Through Collateral Loan Upload.

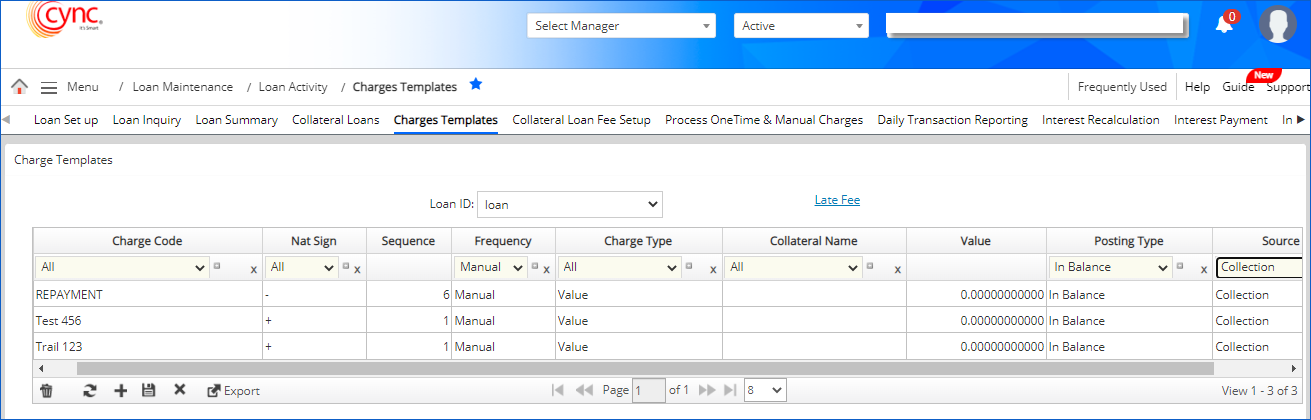

Source Type - Collection

The Frequency and Posting Type for all the Charge codes with Collection Source Type are set to default Manual and In balance respectively. These are non-editable fields.

Refer to the screenshot:

When editing the QA Custom Repayment Charge Code, Frequency and Posting Type fields are not editable field like Sequence, Charge Type.

When editing any of the charge codes with the Advance source type, the Frequency, and Posting Type fields are non-editable.

There is no impact on repayments done through a Cash Application or through Collateral Loan Upload.

There is no impact on repayments done through a Cash Application or through Collateral Loan Upload.

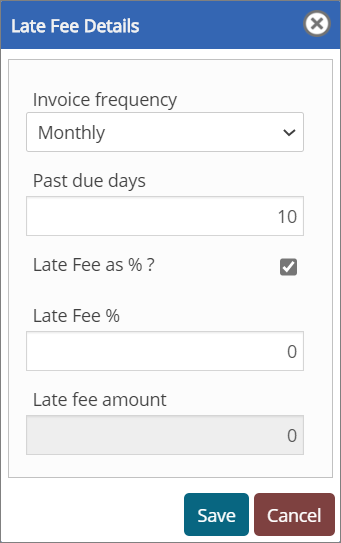

Late Fee

The option allows to specify late fee and defines the invoice frequency. The late fee is applied based on the selected invoice frequency, It includes Monthly, Quarterly, and Annually. You may add the late fee amount or late fee (%).

To add the Late fee, perform these steps:

1. Click Late Fee option, A Late Fee Details popup appears.

2. In the Invoice Frequency drop-down, select the frequency.

3. In the Past Due Days text box, enter the due days.

4. Select the Late fee as % ? to enter the late fee as percentage (%) or clear it to add the Late fee amount.

5. In Late Fee % field, enter the late fee percentage value.

6. Click the ![]() button to save the date or the

button to save the date or the ![]() button to cancel the action.

button to cancel the action.

Refer to the screenshot: